In 2020 COVID unleashed a gigantic financial and economic shock. Shutdown chronicled the desperate struggle to manage the implosion in financial markets and put workers and businesses on life-support. As the uneven economic recovery from the COVID shock continues, the headlines have been dominated by supply-chain issues and price increases. The energy crisis has bubbled up. There are fears that what were once seen as transitory price adjustments may become a self-sustaining inflation. Will we face a comprehensive cost-of-living shock? Might that spill over - Gilets-Jaunes-style - into politics and society? On top of those concerns it has become clear in recent weeks that we must now reckon with a further line of pressure - mounting stress in the financial markets. The bond markets are back to haunt us.

In the last days of October, as attention was focused on the run up to COP26, trouble at Evergrande, or the battle to clinch a deal on Capitol Hill, bond markets had one of their “wildest weeks in decades”.

In markets around the world, bonds have sold off. As prices fall and yields rise, this inflicts losses especially on holders of longer-term bonds. Meanwhile a fall in short-term rates puts pressure on the yield curve.

The yield curve (which maps the way yields vary between short and long-term bonds) normally slopes upwards from short to the long end. A sharp sell-off at the short end flattens the yield curve. Indeed, some exotic parts of the US yield curve - 20 v. 30 year Treasuries for instance - have actually inverted. You get more money lending to the US government over 20 years than if you lend over 30. This is the opposite of what many speculators were reckoning with. Many funds that were gambling on the yield curve to steepen booked substantial losses, adding to painful sense of uncertainty. There have been ominous signs of liquidity drying up.

The headlines are graphic: “Bond rout”; a Nixon moment;

The Bond Market Is a Powder Keg

********

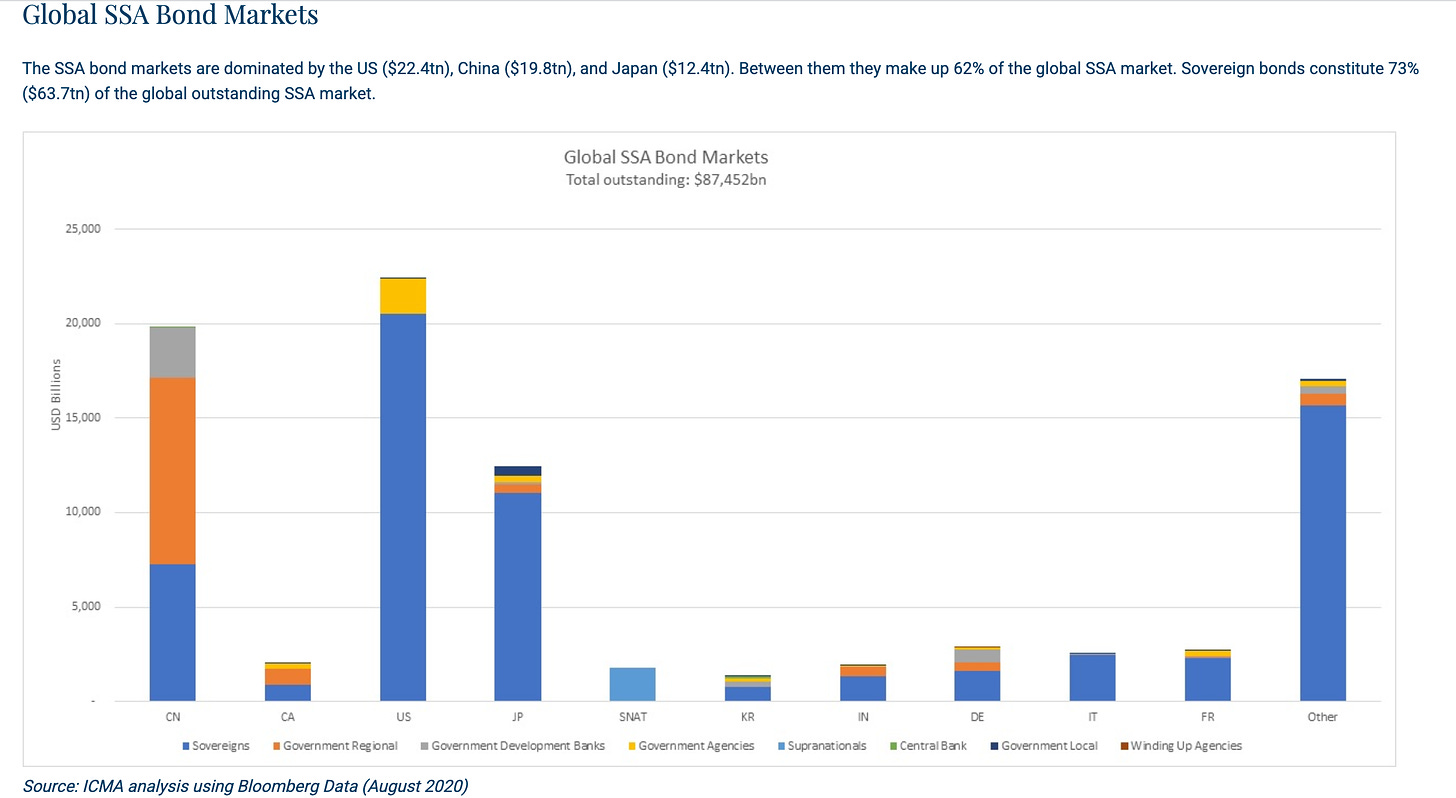

Bonds are less attention-grabbing than brand-name equities, which over the same period have surged to record levels. But the government bond market is vast. $87 trillion as of September 2020.

Source: ICMA Group

The attractiveness of government bonds is dictated not by industry trends or corporate strategies but by general macroeconomic conditions - inflation, currencies, growth etc. The fate of public debt is tied directly to government finance and thus explicitly political. The bond markets are also preeminently the domain of central bank intervention.

When intense selling pressure built up in bond markets in March 2020, the Fed and other central banks stepped, buying trillions of dollars-worth, to stabilize prices and interest rates. This was crucial because bonds are not just the means to raise funds for the government, they are the basis for trillions of dollars of private speculation.

Having stepped in to catch a falling economy, the question in 2021 is how long the central banks can continue their interventions. Since June 2020, the Fed has been buying $80 billion of Treasury securities and $40 billion of agency mortgage-backed securities (MBS) each month. With the economy recovering strongly and prices rising, the question is, when will the major central banks reduce their purchases?

With prices set correctly, the market can live with any inflation and policy scenario. But the question is what to expect.

Inflation is a particular threat to fixed-income assets that pay a fixed interest coupon not dividends. All else being equal, the expectation of higher inflation makes bonds less attractive. Furthermore, central bank interventions have since the spring of 2020 been dominating market movements. Every morning at shortly after 10 am in New York, large purchases begin, setting the direction for the day. Markets could be confident of a large bloc of demand for bonds. But, if inflation surges, central banks will find it impossible to continue with purchases. Price stability remains a key priority for central banks. If they are no longer buying on the same scale, bond prices will fall and yields rise.

There are thus two different motives for a selloff. One driven directly by the investors’ calculations of the likely rate of return. The other driven by investors’ expectations about the likely behavior of the central bank.

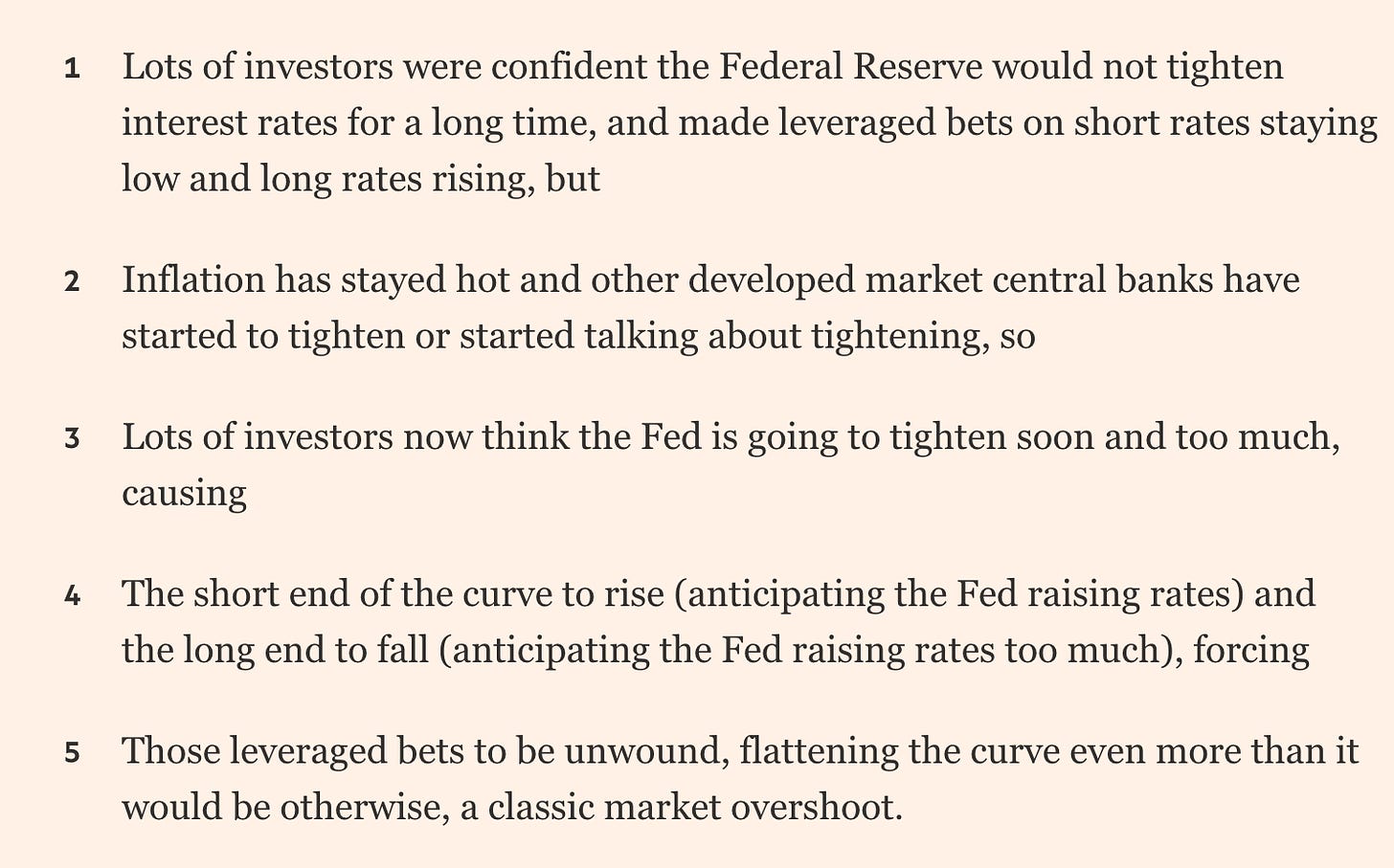

Until recently, the expectation of the markets following dovish communications from the central banks, had been that the Fed and its colleagues would be slow to respond to inflation. A degree of overheating is acceptable within the new central banking policy framework of average inflation targeting. A major factor driving the turmoil of recent weeks has been a reevaluation not just of inflation, but of the likely reaction of central banks to the price increases. The central banks seemed to be moving in a more hawkish direction, suggesting they would end bond purchases sooner and there might even be rate rises on the horizon. That would make it less attractive to hold short bonds (on account of higher inflation expectations) and more attractive to hold long bonds (on account of lower inflation in future) thus flattening rather than steepening the yield curve.

The central bank, for its part, must take price stability seriously, but it must also reckon with the bond markets. It will not want to be seen to be dragging its feet. On the other hand central bank action to withdraw support just as bond investors are selling and driving yields up, risks strangling the recovery.

**********

What is playing out in the markets right now is a hugely delicate rebalancing towards the expectation that current inflation is more serious and more long-lasting and that central banks will likely respond more vigorously and hawkishly than expected.

As John Authers sums up the situation: “it was in October that financial markets switched from nonchalance about inflation to instead try to pressure central banks toward raising rates.”

The focus of attention is on the Fed. The US Treasury market is the anchor of the whole system and the Fed the most important central bank. Today, (Wednesday 3 November) all eyes will be on the FOMC as it concludes its meeting to discuss the future course of policy.

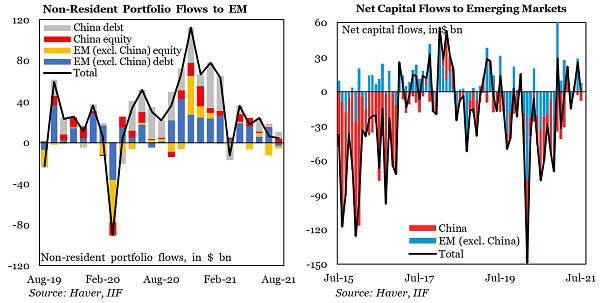

But the logic of bond markets ties much of the world into an interconnected system. It is telling that signs of bond market stress did not start in US, but in the emerging markets (EM).

All year, the EM have been living under the shadow of an anticipated tightening in monetary policy by the advanced economy central banks. If the Fed tilts strongly in a hawkish direction money will flow back to the US to take advantage of the better yields. For several months, bond markets around the EM have seen lower prices and rising yields.

The core-periphery relationship is powerful. But it is also one-way. The EM import pressure from the AE. They do not transmit it to the same degree.

In the last few weeks what we have seen is another dynamic playing out. In rather an unusual pattern, selling pressure in Canada, Australia and the UK has set the pace. This in turn is blowing back on the US.

Canada, Australia and the UK are not “peripheral” to the global financial system in the sense, for instance, that South Africa is. What they have in common is that they are medium-sized advanced economy monetary sovereigns. They have the confidence and authority of advanced economy monetary and fiscal actors, but they are exposed to a full set of inflation, interest rate and exchange rate risks. They are small-scale analogues, you might say, for the US.

Last week, Canada abruptly stopped it QE program. Australia abandoned the defense of a low interest rate.

As Authers describes it:

Most spectacularly last week, traders bet that the Reserve Bank of Australia, which has long targeted keeping three-year bonds, due in April 2024, to a yield of only 0.1%, would have to abandon a policy in place since March last year. On Friday, the bank gave up intervening to keep the yield close to its target, with dramatic results:

The Bank of England has also been sending strongly hawkish signals.

The news from the Anglosphere sent shockwaves through bond markets globally. So far, the Eurozone has remained reasonably calm. Inflation rates for the eurozone as a whole are relatively muted, as is the recovery. If there is a central bank that seems credibly committed to not tightening too soon it is the ECB. Nevertheless, in the last week, pressure has begun to mount on Italy and Spain.

But the question that comes to a head at 2 pm Eastern Time today (November 3) is how the Fed will declare. The expectation is that it will announce a taper path for its bond purchases but will refuse to commit to rate rises. As chair, Jerome Powell has invested considerable capital in the idea that inflation was transitory. The evidence continues to support that view. What has changed is that the period of price adjustments appears to be more protracted than expected. In the face of market pressure, the Fed is expected to make a staged retreat.

This will be a delicate operation. If the Fed tightens too hard, too fast, it will exert painful pressure on the EM. This was the taper tantrum scenario of 2013. But what will matter more in 2021 are concerns for the health of US equity markets.

Bond market and equities are currently in different worlds. Whilst the bond markets are in turmoil, shares are going from record high to record high. VIX the equity volatility index is at record lows, even as volatility in bond market surges.

If the central banks push too hard, will they bring the house down?

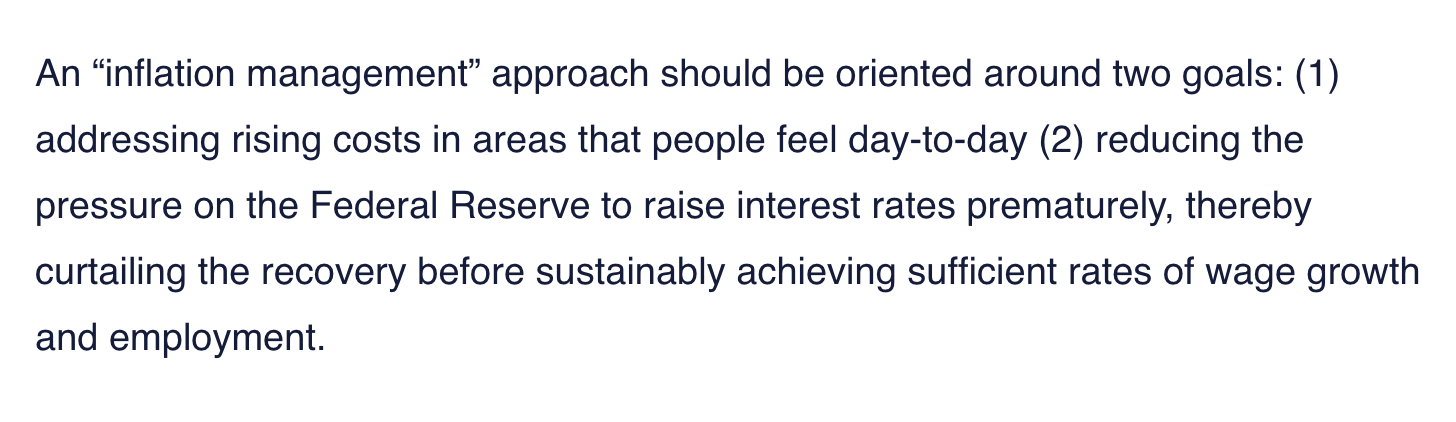

As Robert Armstrong remarks, the fear among many big players in the market is that the central banks will act prematurely. For fear of inflation they will kill the recovery.

With China also applying the brakes, that would imply a major shift in policy stance across the world economy.

As Armstrong sums it up with admirable brevity:

Are the central banks about to do what they have frequently done before, which is to stifle a recovery prematurely?

If one believes that the problems are mainly issues of supply-side bottlenecks and logistical difficulties, using a tightening of monetary policy is a crude way to deal with the problem. Neo-Keynesians like Skanda Amarnath and Employ America are full of smart ideas about how to curb inflationary pressures short of using interest rates to cosh aggregate demand.

Meanwhile, stalking the markets is the fear of something even worse than a premature tightening or spillovers to equities and the EM. The most pressing question is, can the Treasury market take the strain?

**********

The US market is by far the largest in the world. It is the true hub of the global financial system. When we talk about the dominance of the dollar, what we really mean is the dominance of dollar-denominated Treasuries as reserve assets.

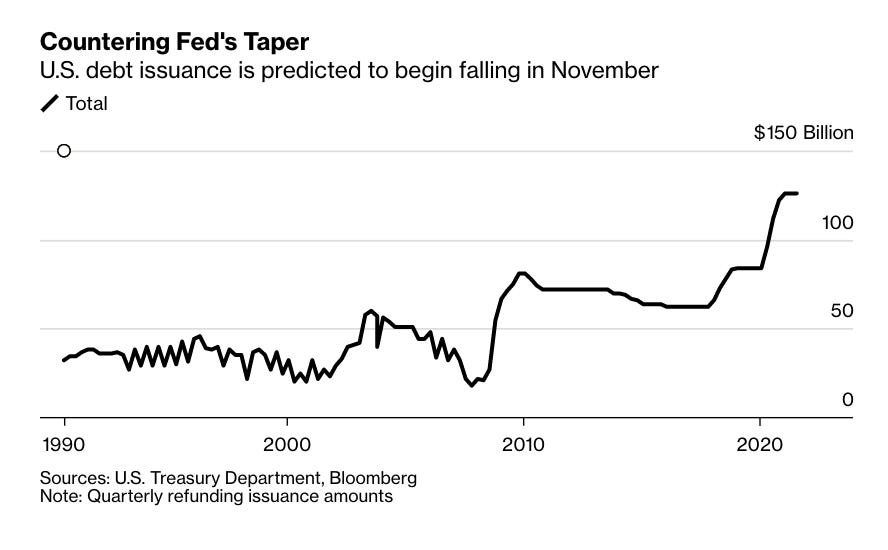

The volume of US Treasuries in the portfolios of private investors is huge and rapidly growing as the US authorities issue more and more debt.

Source: Bloomberg

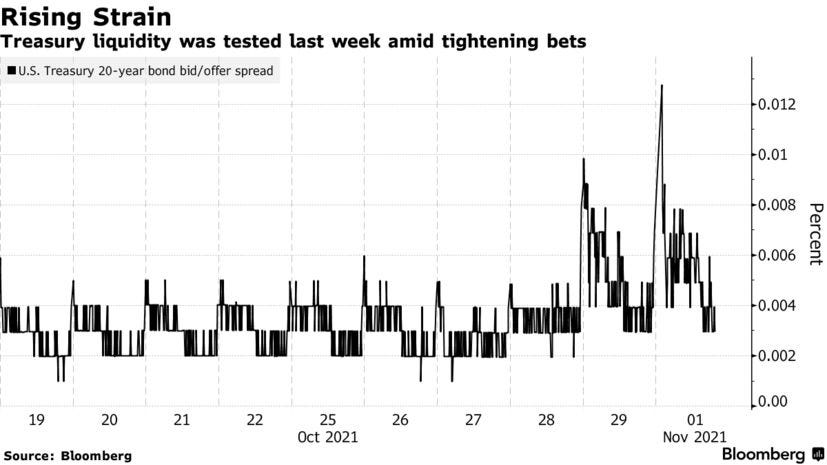

Huge it may be, but the disconcerting realization of the last two years has been that the US Treasury market is also prone to breakdown. Some of the turmoil of recent weeks was due not simply to a shift in macroeconomic and policy outlook. Some of it had to do with malfunctioning of the market. At the short-end liquidity tightened and pricing became erratic.

Nor is this the first time. In September 2019 there was the repo crisis. In March 2020 the market came close to failing. In February 2021 there were a rash of worries as demand for Treasury issuance briefly dried up. And now, in recent weeks we have again seen symptoms of market stress and malfunction.

In the last days of October, big selling pressure did not meet with adequate demand, leading to an alarming surge in the bid/offer spread, an index of market stickiness.

Source: Bloomberg

The mismatch between demand and supply seems to have had two sets of causes.

The sudden and unexpected flattening of the yield curve triggered losses in hedge funds which were betting on steepening. That in turn triggered sell-offs, which put the the market under pressure.

On the demand side there is a suspicion that the so-called primary dealers - the 24 financial firms that are charged by the Fed with providing buy and sell prices for Treasuries - were less than willing to absorb the selling pressure. I have not yet, so far, seen any specific data on this for October. But data for Feb 2021 and March 2020 do show a reluctance on the part of the primary dealers to expand their balance sheets. This is commonly blamed on the Dodd-Frank regulations in the wake of the 2008 financial crisis which force banks to set aside more capital to back their holdings of debt.

Primary dealers are less willing to put huge balance sheets in play to make the repo market work.

Source: FT

As you would expect this is a prime area for industry lobbying:

“The banks never were there to catch the falling knife but they certainly did act as a pretty huge liquidity buffer to the marketplace in a way that they can’t or won’t today,” said Kevin McPartland, head of market structure and technology research at Coalition Greenwich. The Securities Industry and Financial Markets Association, an industry lobbying firm representing big lenders, wrote earlier this year that changing bank balance sheet rules would ensure smooth market functioning. “Some modest loosening of primary dealer balance sheets would likely help reduce these more frequent bouts of volatility, and we would still have a much safer system” than before the financial crisis, said Tyler Wellensiek, global head of rates market structure at Barclays.

The argument against any such loosening is strong. At least in the current situation we do not have to deal with a dangerously unstable and oversized bank balance sheet. As the Financial Times explains:

As primary dealers have stepped back from their market-making role, hedge funds and high-frequency traders including Citadel Securities, Virtu Financial and Jump Trading have moved into their place. But when markets become volatile, high-frequency trading funds also can pull out. Data from Coalition Greenwich show that order-book volume — a large portion of which is made up of high-frequency trader activity — has shrunk during recent liquidity glitches. In March last year, average daily order book volume on a relative basis compared to other execution methods dropped to the lowest level since 2014 and has not fully recovered since.

Source: FT

The system as a whole looks highly unstable. The Treasury market, “is primed so that high-frequency traders and primary dealers pull back when there are problems”, said Yesha Yadav, a professor at Vanderbilt Law School in Nashville who studies Treasury market structure and regulation. “The way this is set up is designed to fail. It is exceptionally fragile,” Yadav said.

Yadav has just put out a Columbia Law Review article on Treasury market structure and its fragilities which I highly recommend. The picture she paints is alarming:

The asymmetric distribution of regulatory burdens between primary dealers on the one hand and high-speed securities firms on the other limits opportunities for private cooperation and mutually reinforces risk-taking behavior by both sets of players. Unwieldy public monitoring, combined with a light-touch rulebook, allows all firms to take risks or trade opportunistically with little chance of detection and discipline. Traders can also cheaply exit the market if something goes wrong, limiting how fully they must internalize the costs of their risky behavior. For the less-regulated, nonprimary dealer firms, the regulatory constraints are even weaker, further increasing their financial incentive to seek risk in Treasury markets. Faced with diminishing profits and a less lucrative franchise, primary dealers are also incentivized to take risks and shirk self-discipline. So, not only is the task of private oversight logistically harder as the number of traders proliferates and diversifies, but it is also problematic when self-policing would result in primary dealers imposing added costs on themselves in a period of fierce competition and lower profits. The consequences of this regulatory neglect in Treasury markets were apparent even prior to the March 2020 COVID-19 crisis, as a number of disruptions over the years pointed to unaddressed fragilities at the heart of this supposedly failure-proof market.

Regulators have discussed making changes to bolster Treasury market liquidity. There have been recommendations also from the G30.

But progress has been slow and the lack of a centralised Treasury market regulator can cause confusion.

Yadev’s first proposal for stabilization would be a binding Memorandum of Understanding between the regulators themselves to create a clearer division of labour between them.

Her second proposal takes up the suggestion from Darrel Duffie for a centralized Treasury clearing house model that would ensure that all major players had skin in the game in ensuring that the market continued to function even at moments of stress.

Others go even further. In the view of Bank of America analysts: “Treasury market size “has outgrown dealer ability to effectively intermediate risk.” This then requires an “official-sector role as dealer of last resort.””

********

What the repeated shocks to the Treasury market have revealed since 2019 is the instability and incoherence of the market mechanisms which govern the trading and pricing of the world’s most important safe asset. Since the liquidity of Treasuries - the fact that you can turn them into ready cash very easily - is part of what makes them into the global safe asset, the fragility of the market is a fundamental challenge.

The current turmoil drives that lesson home.

Advocates of the MMT position will no doubt be moved to remind us that our reliance on government issues IOUs is a matter of choice. There are other ways of funding government. We choose to issue interest-bearing IOUs and to allow a market for them to exist.

This is, indeed, a crucial insight. Unfortunately, it does not follow that ending the system and replacing it with something radically different is plausible politics. But it forces the question of how we organize this market and how we distribute the profits and the risks.

After the series of shocks we have witnessed in recent years, we should do so proactively, before we are forced to do by an even more serious crisis. The market can no longer claim to be autonomous. It moves with speculation about Fed interventions and the slightest word from the central bank. Since the Treasury market is already a creature of policy. Let us tame it. Whatever policy stance and whatever policy mix we choose, if we are going to have a market-based public debt system at the heart of the global financial system, let us make it a solid platform.

Adam, are you five researchers? Absolutely brilliant analysis. Frankly in awe of your warnings and observations.

Great post overall! One nitpick: "As chair, Jerome Powell has invested considerable capital in the idea that inflation was transitory. The evidence continues to support that view. What has changed is that the period of price adjustments appears to be more protracted than expected." I think a more honest way to put it is "But inflation has persisted at high levels, reducing confidence that it is, in fact, transitory". "More protracted transitory inflation" is some galaxy-brain central banker language to try and ignore reality.