Source: Foreign Policy

On February 13 2021 Mario Draghi was sworn in as Italy’s Prime Minister.

In early 2021 Draghi is not the only veteran being called back to the colors. In Foreign Policy I did a long read on the intertwined trajectories of Mario Draghi and Janet Yellen as emblematic technocrats of the neoliberal era. In this newsletter I want to focus on Draghi and in particular on his early career in Italy as a way of better understanding the stakes involved in his late-life premiership.

Draghi’s appointment as Prime Minster was both a surprising choice and an obvious one.

Draghi retired from the ECB in November 2019 after a legendary stint. Not much was heard from him in 2020. As far as Europe was concerned his mission was accomplished. The ECB under Christine Lagarde continued his legacy keeping credit flowing and stabilizing the bond market. The NextGen Eu program of July 2020 promises (Germany’s constitutional lawyers permitting) to make good on the promise of a fiscal capacity for Europe. The Euro - which Draghi once compared to the ungainly bumble bee - is evolving into a more reliable flying machine. That progress, however, poses new questions.

Thanks to NextGen EU, Italy will receive 209 bn euros in funding over five years, c. 10 percent of its 2020 GDP. This injection, properly deployed, is a historic opportunity to boost national economic growth. But who in Italy’s political class, has the wherewithal to put such a program into action? Matteo Renzi, once the golden boy of Europe’s center left is now reduced to the role of the spoiler and, over the winter of 2020-2021, spoil he did. In January 2021 he felled the Conte government. It was then that the finger of fate pointed at Draghi.

Italy needed its safest pair of hands. In recent decades, amongst European leaders only Angela Merkel has greater stature. Both their careers in the limelight began in the early 1990s. But, whereas Merkel in 2021 is preparing to step down, Draghi has been summoned for a final act. Draghi’s task is not that merely that of a fire-fighter. Viewed against the arc of Italian history, the challenge facing Draghi in 2021 is to vindicate not just his own life’s work, but that of his entire generation.

Draghi moved to the forefront of Italian politics in the early 1990s as a group of centrist politicians struggled to anchor the Italian ship of state by attaching it to the common currency area envisioned by the Maastricht Treaty. Crowbarring Italy into the euro was a historic wager. The so-called vincolo esterno (external constraint), they was hoped, would constrain indiscipline and drive domestic reform. Thirty years on, where does the wager stand? The data tell a grim story. Rather than converging, Italy’s GDP per capita has fallen away from that of its European peers.

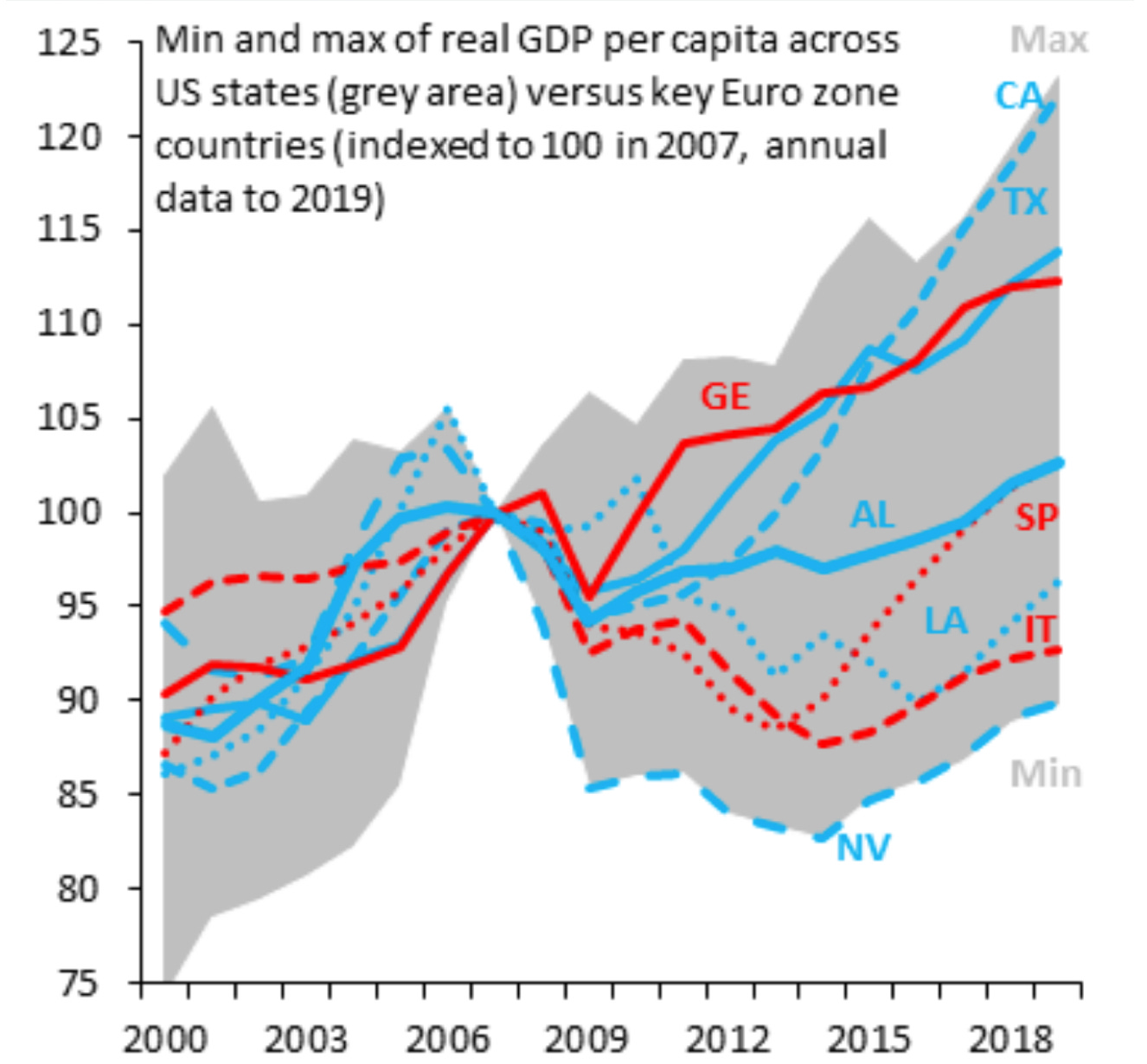

Source: IIF

The IIF team headed by Robin Brooks also compared national inequalities within Europe with regional inequalities in the United States. The divides in Europe are as large between the winners and loser in a polarized America. After twenty years in the Euro, in 2019 Italy stood relative to Germany as Louisiana did to Texas. The covid crisis has made it worse. It seems reasonable to surmise that this gap - reflected above all in low growth and chronically high unemployment - is at the root of the political fragility, which forces Italy’s elite to call on Draghi in 2021.

Source: IIF

As Servaas Storm recounts in a brilliant paper, in 2017 when the Banca d’Italia advertised 30 entry level junior positions it was inundated with 80,000 applications from young people desperate for gainful employment. With Italy’s democratically elected politicians having abdicated to Draghi, can he restart the growth that Italy desperately needs? As this excellent piece by my friend and colleague Carlo Invernizzi Accetti spells out, it is a high stakes gamble.

So how did Draghi, get to be Draghi? During his time at the top of the ECB, many of us became obsessive Draghi-watchers. Recently, Jana Randow and Alessandro Speciale covered this ground in their excellent history of Draghi at the ECB. One can only hope that an English edition will soon be available.

But a preoccupation with Draghi is not innocent. To the Italian left and left-wing eurosceptics in particular, Draghi is the epitome of a neoliberalism eurocrat. See, for instance, Thomas Fazi or Sergio Cesaratto. I was sucked in whilst writing Crashed, but also by my long-standing interest in the post-89-”end of history” moment. If it is true that it is easier to imagine the end of the world than the end of capitalism, then, figures like Draghi are part of the reason why.

Draghi has many admirers. A particularly rich source are the essays and the twitter feed of Alessandro Aresu. To get a sense of Aresu’s take, check out this twitter thread of 39 thoughts on Draghi in the form of an article. Long essays by Aresu and Andrea Garnero on Draghi in Limes and Le Grand Continent set a high bar for Draghi commentary. Aresu’s fascination with Draghi relates to his broader interest in the future of the Italian ruling class. On his project of creating an “Italian ruling class suited to a globalized world”, there is a revealing interview here.

In one of his threads Aresu remarks that he has never met or personally contacted Draghi, it must then have been rather dizzying to be summoned in March 2021 to join the Draghi administration. It’s a small world!

Mario Draghi is a classic postwar success story. He was born in September 1947 in Rome in relatively comfortable circumstances. His father’s career seems almost to have predestined his own. Carlo Draghi, originally from Padua, joined Banca d’Italia in 1922, moving to fascist Italy’s national industrial holding company, IRI, in the 1930s and then to one of Italy’s “policy banks”, the Banca Nazionale Del Lavoro.

Orphaned in his early teens, Draghi attended a famous Jesuit high school in Rome before studying economics at Sapienza University. His mentor there was one of Italy’s leading Keynesians Federico Caffè. Graduating in 1970, Draghi gained a one-year scholarship at MIT, to work with Franco Modigliani. Having earned his place on MIT’s prestigious PhD program he would graduate in 1975 with a thesis supervised by Modigliani and Solow.

For those interested in Draghi’s own academic formation in the 1970s, his MIT PhD is here. The most interesting of the three essays that make up the thesis is the third one.

“The last chapter is concerned with the tradeoff between short run stabilization policies and long run plans. A planner tries to control a short run economy characterized by variable unemployment rates. The benchmark path is an optimal full employment growth path reflecting the planner's preferences. It is shown that if the planner implements the policies suggested by short run optimization, the long run path will never be reached. On the other hand, if policies that are optimal from a long run point of view are actually enforced on the short run economy, this will not be destabilized in a finite time and the optimal growth path will be achieved.”

Draghi doesn’t give a lot of personal interviews. The most in-depth one is this conversation with Die Zeit. Most of it consists of Draghi politely batting away unselfconsciously grating questions. Is his work ethic a bit “German”, the journalists ask? Prompting Draghi to explain that there are lots of countries with work ethics. By his own account he learned the meaning of hard work when he was at MIT, topping up his stipend with teaching and an evening job at a local computer firm (apparently Draghi is good at Matlab).

The interview is a case study in how to deal with journalistic micro-aggression, but there are also some truly revealing bits, including the fact that Draghi’s family’s modest inheritance was wiped out by the Italian inflation of the 1970s. Once again turning the point against his German interviewers, he points out that an Italian doesn’t need to live off inherited memories of the Weimar Republic to know that serious inflation is bad news.

There is also a telling anecdote about Draghi’s efforts to teach Paul Samuelson’s views on capitalism to the notoriously radical students of the University of Trento.

Draghi describes his own politics at the time as nonconformist “liberal socialist”, which makes it easier to understand how he could have been a student of Caffè.

What did Draghi make of Italy’s period of crisis in the late 1970s and the abortive historic compromise between the communist party and the christian democrats? I haven’t so far been able to find any particularly good sources. In any case, it can hardly be by accident that in 1984 he booked his ticket back to the US and the World Bank.

At the same moment, the “years of lead” touched Draghi’s extended circle in Italy. In March 1985 the labour economist Ezio Tarantelli was gunned down by Red Brigade terrorists. Like Draghi, Tarantelli had followed the track from Sapienza to MIT. What made him a target was that he had played a key role in the restructuring of Italy’s automatic wage indexation system instituted by the Craxi government with the so-called Valentine’s decrees of February 1984.

Two years later, in March 1987 Caffè, Draghi’s academic mentor, disappeared under mysterious circumstances. To this day it is unclear whether it was suicide or a sudden retreat to a monastery.

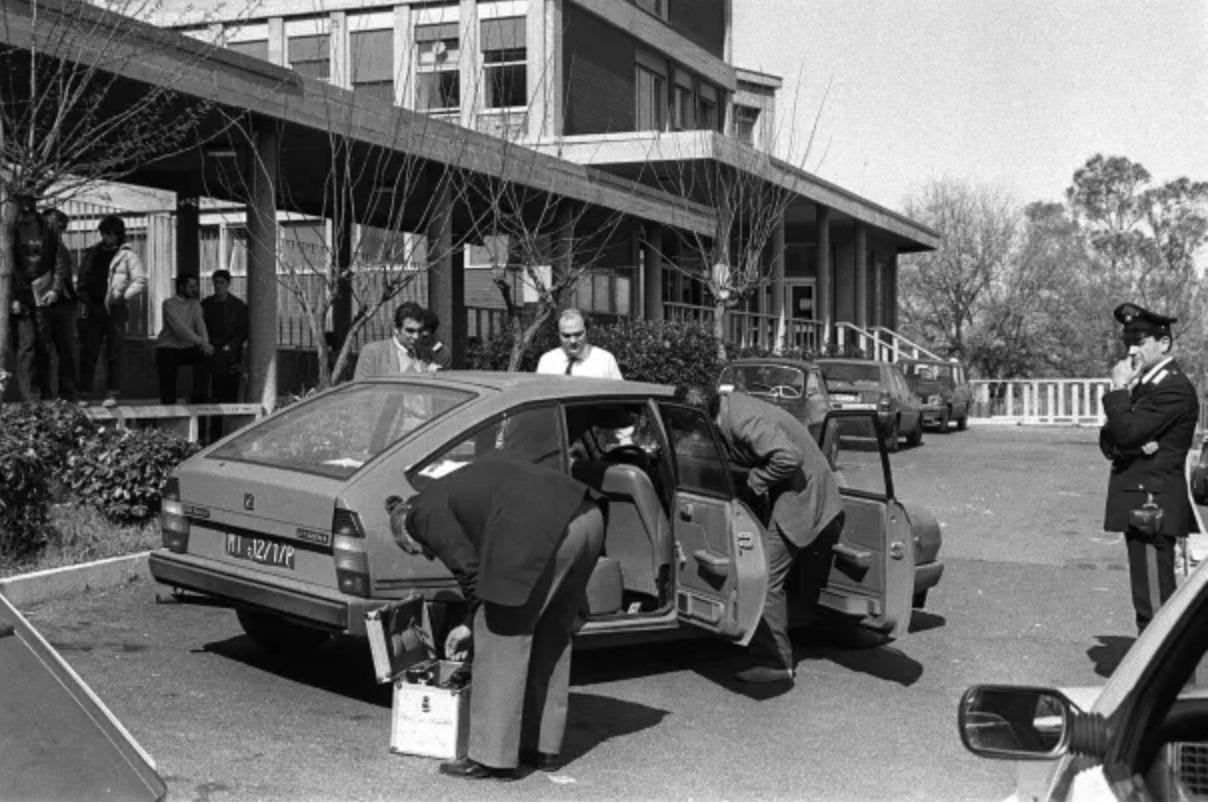

This photo was taken in February 1987 only weeks before Caffè disappearance. It shows Carlo Azeglio Ciampi , then governor of the Bank of Italy, shaking hands with the then Foreign Minister Giulio Andreotti . In the center, the president of the World Bank Barber Conable visiting Italy, Mario Draghi at the door . (ANSA).

In 1990 Draghi along with Mario Monti was appointed by Treasury Minister Guido Carli (1914-1993) - a former Director of the Bank of Italy and pivotal figure in Italy’s twentieth-century economic history - to a commission that was reviewing Italy’s fascist-era banking laws. The association with Carli put Draghi in the frame to be recommended to take the job as Director General of the Italian Treasury in 1991.

What Rome needed was someone to manage Italy’s debt. Piled up during the 1970s and early 1980s it had subsequently been inflated by the high interest rates necessary to stop inflation. By 1994 it would peak close to 120 percent of GDP.

To make matters worse, months after Draghi’s return to the frontline in Rome, all hell broke loose. On February 7 1992 the Maastricht Treaty was signed. Feb 17 1992 saw the first indictments in the Tangentopoli corruption crisis. April 5-6 1992 was the last general election of the old Italian party system. In April 1992 Cossiga resigns as President, after (ex-PCI) Democratic Party of the Left begins impeachment proceedings due to his involvement in the Cold War Gladio organization. On May 23 1992 a Mafia bombing kills Prosecuting Magistrate Falcone. In July 1992 German interest rates reach record levels of around 9.75%. On 10 July 1992 desperate for funding, the Italian government led by Giuliano Amato levied overnight 0.6 percent wealth tax on bank deposits. On Aug 28 1992 the Lira fell through the floor for the exchange rate fixed by Europe’s Monetary System. On September 17 1992 Italy crashed out of the EMS’s ERM.

For a gloriously Eurotrash period treatment of the crisis, check out the TV series 1992. For a more scholarly treatment, this essay by Silveri is a good start.

In the aftermath of 1992, Italian membership in monetary union seemed like a long shot. The UK, which also dropped out of the ERM in September 1992, never looked back. It embarked on the route of central bank independence with a floating exchange rate. By contrast, amidst the chaos of Italy’s political crisis, Draghi and Italy’s centrist political elite clung to Europe as an anchor of stability - the vincolo esterno.

The strategy is nicely summarized in a recent blogpost by Ian Begg and Kevin Featherstone, who have written extensively on Italy’s 1990s crisis.

“The constraint countered the propensity of political leaders who, with their electoral interests in mind, were prone to take the soft options, particularly what was dubbed protezionismo interno (internal protectionism). This involved a politics of ‘clientelism’ – dispensing favours to groups that could be relied on, in return, to keep the politicians in power – and a resistance to open, competitive markets. The conflict between the two pressures was akin, Carli noted, to that of the ‘Two Souls of Faust’.

Deeper economic integration, first through the single European market and subsequently through the strictures of the eurozone imposed tougher policy discipline on governments. As a result, governments accustomed to dispensing favours in what was a form of crony capitalism had to bow to the vincolo esterno. It enabled them to push through reforms they tacitly welcomed, while avoiding much of the blame. As such, it can also be seen as a form of constructive hypocrisy: “not my doing, guv, but no choice”.”

As Draghi himself acknowledged in a speech he gave in 2011, the external constraint strategy has an obvious risk - expecting salvation to come from outside: “It is important that we all be convinced that the salvation and revitalization of the Italian economy can only come from the Italians. One of our atavistic temptations, mentioned by Manzoni, is to wait for an army from beyond the Alps to solve our problems ”.

In the 1990s Draghi wasn’t waiting for salvation. The Italian Treasury imposed fiscal discipline, restructured the administration and privatized. State-owned enterprises in electricity (ENEL), insurance (INA), petrochemicals (ENI) and industry and banking (IRI) were sold between 1992 and 1998. Draghi’s most famous speech in the national context of Italy is his speech on privatization on Britannia. To make Italy’s debt more manageable Draghi resorted to techniques of financialization that have a track record in Italy that goes back to the 1970s. See this interesting piece by Nützenadel.

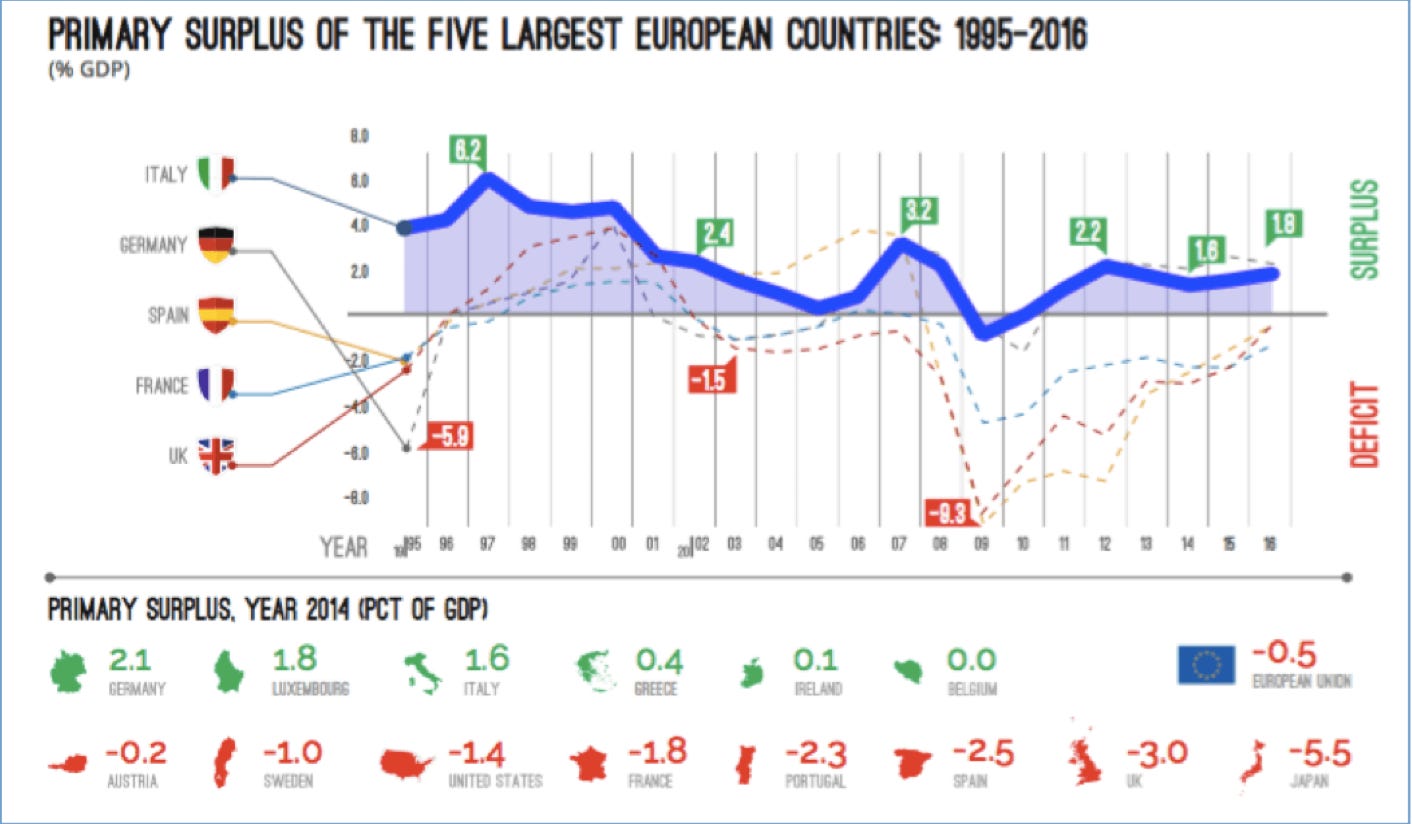

In fiscal terms, Italy’s position recovered. It bears repeating, as Philipp Heimberger has valiantly made it his mission to do, that Italy has long sustained the toughest fiscal stance in Europe.

The origins of Italy’s economic malaise are complex and hotly disputed. Baccaro and D’Antoni (2020) offers an excellent review. But the fiscal squeeze and wage compression clearly undeniably had the effect of smothering domestic demand, particularly as they were continued into the early 2000s.

Source: Notermans and Piatonni (2021)

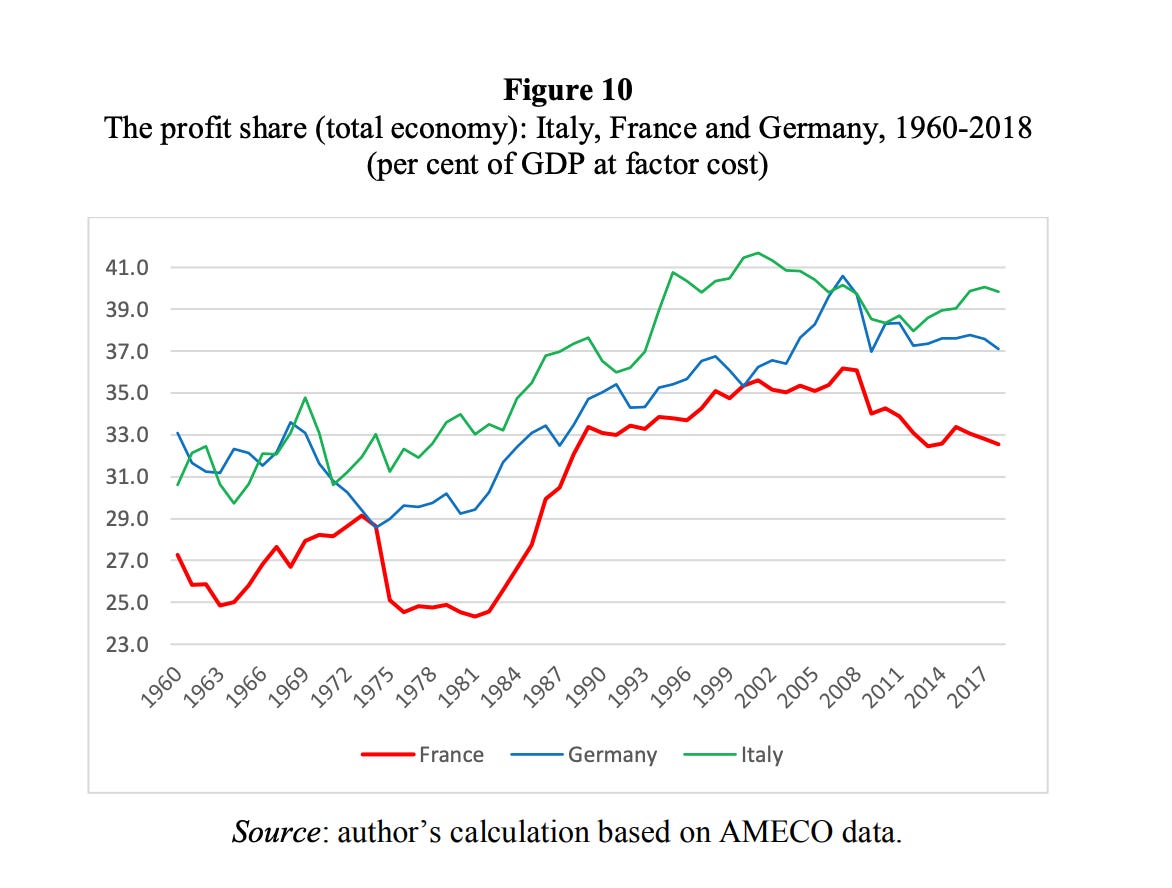

Meanwhile, as wages were held down, the profit share soared.

Source: Storm

Though taming “democratic money” (Dornbusch) was at the heart of MIT macroeconomics in the 1970s and 1980s, exchange rate pegs were not their preferred option. Making central banks independent and separating them from Treasuries was the usual recipe. Creating an ECB was a bridge too far. The balance of opinion in the saltwater school of macroeconomics is strongly eurosceptic. This has dogged Draghi. How did it feel in 1998 to find himself facing an economist’s manifesto headed by Modigliani and Solow calling for supply-side reform to be coupled with coordinated reflation? If Draghi agreed, as he may well have, he was tongue tied. Years later, Randow and Speciale recount an incident when Draghi clashed with Yellen over her unrelenting and uncomprehending attacks on the fundamental non-viability of the euro. Draghi snapped that Yellen was being “unconstructive”. It was Draghi’s frustration with the incomprehension of Mervyn King and City of London types that vented itself in “whatever it takes” in 2012.

For Draghi’s generation of Italian centrist politicians and technocrats European monetary integration is indeed more than an economic policy. It is a historic project of state-building. It encapsulates an entire vision, both of modernity and modernization. It is only viable, however, if it is actually vindicated by growth, if the vincolo externo does not become self-strangulation and if the resulting frustration does not spill over into political delegitimization. That is the scenario that Draghi faces today.

Twenty years ago, the prospects seemed rosier. In 2001 when Berlusconi was again elected Prime Minister, Draghi took his leave. Berlusconi was a populist showman. But in policy terms he was boxed in. Draghi could safely return to his globe-trotting ways, starting with a stint as a visiting Professor at Harvard, followed by Goldman Sachs. As legend has it, in the fall of 2001 Draghi announced a course on the eurozone at the Kennedy School but then decided to cancel it. The topic struck both him and his students as too boring.

With special thanks to Philipp Heimberger for a bunch of great reading!

It's always nice when elites so clearly spell out their disdain for Democracy and their absolute certainty that through their smarts, hard work, and skills they (and most other elites they know) managed against all odds to hit a homerun; totally oblivious to the fact that they were born on 3rd base. Having all but eliminated democracy by joining the Eurozone; by some miracle he gets a 2nd chance and immediately starts shoveling money into the useless A-Moral cesspit that is McKinsey. One can only wonder what the brains behind "give doctors bonuses for killing patients with opioid OD's" have in mind for Italy, but I can't imagine why anyone would stick around to find out.

Adam,

I've been following your work for a while and appreciate your technical [bounded in political] perspective on these issues. My coworkers and I work in national security and are working on a project with an economic focus and would appreciate your expertise re: chartbook #9.

Matt @ m.p.dubya@gmail.com