Chartbook #133 Under the hood of the power dynamics of inflation

In 2021-2022 we are living through something very unusual - a historic break, a sudden shift from a low inflation regime, that had persisted for several decades, to a moment of much higher inflation.

Amongst those who fear inflation, it is raising deep and concerning questions. Might we be entering a new era, a new regime of higher inflation? What, previously, anchored the regime of low inflation that we have for so many decades taken for granted? Looking back, the last time we overcome rapid inflation - in the late 1970s and early 1980s - how was it that the new regime of lower inflation was institutionalized?

What is fascinating is that in answering these questions, even at a technical level in reports by an agency like the Bank of International Settlements, the underlying regime of power is thematized. In a remarkably unselfconscious way, the managers of the system articulate their preference for a particular configuration, or non-configuration of social forces.

An inflation regime, as the BIS defines it, is one of sustained and general price increases. This cannot be a one-round affair. It requires successive price and wage adjustment. It can only happen if you have a wage-price spiral, with both price and wage setters driving up their demands.

Sustained inflation ultimately involves a self-reinforcing feedback between price and wage increases – so-called wage-price spirals. Changes in individual prices can broaden into aggregate inflation. And they can also erode real wages and profit margins for very long spells. But, ultimately, they cannot be self-sustaining without feedback between prices and wages: profit margins and real wages cannot fall indefinitely. So, beyond the important impact of aggregate demand conditions on wage- and price-setting, a key question is how changes in relative prices that pass through to the aggregate price index (“first-round effects”) can trigger feedback between price and wage increases (“second-round effects”).

If this is what defines inflation, what anchors a low-inflation regime is a situation in which that reciprocal action cannot take hold. Either, neither price-setters (corporate capital) or workers have the power to set prices, or only one side does, so that you can have a first round price shock, but no second-round reaction.

The BIS is careful to frame its argument symmetrically. It treats pricing power and wage-setting power as dual challenges to inflation-control. What it does not comment on are the inequality implications. It does not remark on the fact that the actually existing low-inflation regime of the period since the 1980s opened the door to huge inequality. Nor does it address the question of power as such. Allowing that inflation-control is important, it is, however, only one possible consideration. Independently of the question of inflation-control, what kind of order of social and economic power do we actually prefer?

The BIS’s look under the bonnet of inflation is extraordinarily illuminating.

Low-inflation regimes turn out to be very different from high-inflation ones.1 When inflation settles at a low level, it mainly reflects changes in sector-specific prices and exhibits certain self-equilibrating properties. Changes in inflation become less sensitive to relative price shocks, and wage and price dynamics are less closely linked. Moreover, there is evidence that the impact of changes in the monetary policy stance becomes less powerful. Transitions from low- to high-inflation regimes tend to be self-reinforcing. As inflation rises, it naturally becomes more of a focal point for agents and induces behavioural changes that tend to entrench it, notably by influencing wage and price dynamics. This puts a premium on better understanding how transitions work in order to be able to identify them early enough as events unfold. The transition from a low- to a high-inflation regime in the late 1960s and early 1970s illustrates some of the possible forces at play. These include large and persistent relative price increases – notably oil – in a context of strong cyclical demand and in an environment structurally conducive to wage-price spirals, ie high pricing power of labour and firms coupled with the loss of the monetary anchor provided by the Bretton Woods system. Monetary policy plays a key role in establishing and hardwiring a low-inflation regime and in avoiding transitions to a high-inflation one. Once a low-inflation regime is established, monetary policy can afford to be more flexible and tolerate more persistent, if moderate, deviations of inflation from targets. Having gained precious credibility, it can reap the benefits. At the same time, monetary policy must ensure that the regime is not jeopardised. It is one thing to tolerate moderate deviations from point targets; it is quite another to put the system’s self-equilibrating properties to the test. The costs of bringing inflation back under control can be very high. Calibrating policy to prevent transitions is especially challenging.

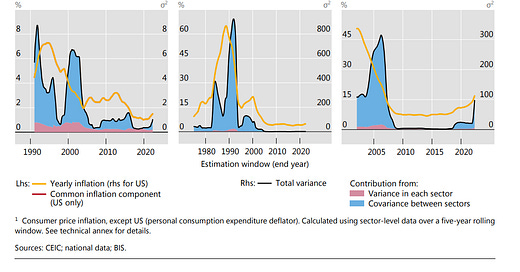

As in the 1980s inflation fell to persistently lower levels, it also became less volatile. And this was due not to lower volatility in the individual price series, but rather a decline in the correlation between them. General (macro)economic conditions mattered less and less. What came to the fore instead were particular (microeconomic) market forces.

Insofar as the overall index continued to fluctuate, it was mainly driven by idiosyncratic shocks operating independently in particular sectors. The importance of the common factor operating across all components of the index diminished proportionally.

As inflation was squeezed out of the system, the remaining price movements became more and more microeconomic in origin. Interactions between prices mattered less and less.

Given the BIS’s definition of inflation as a sustained race between wage and price-setters, this shift must ultimately be rationalized in terms of the operation of the labour market. What changed to mean that wages and prices were no longer tightly coupled together?

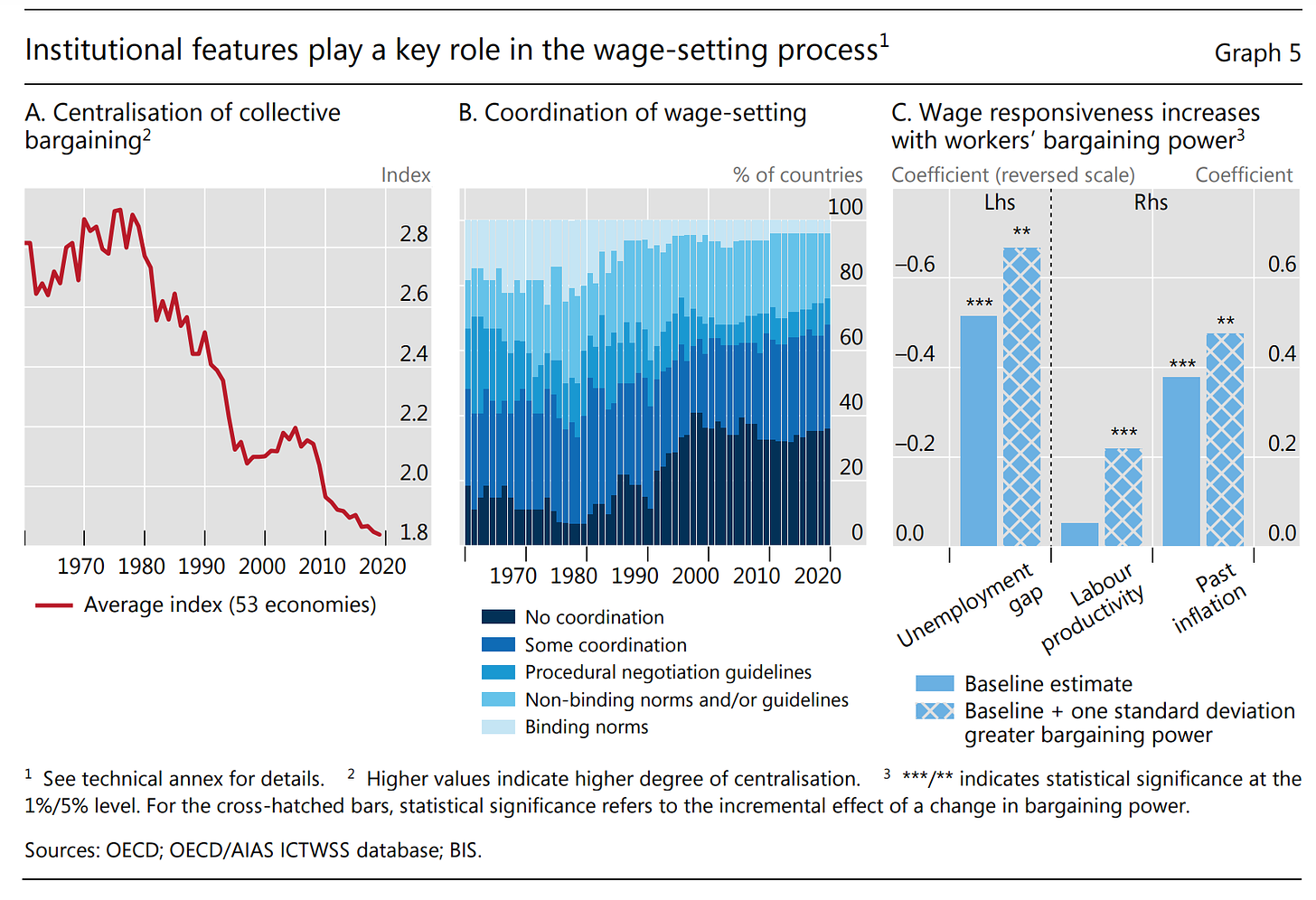

The evolution of labour markets vividly illustrates how broad and deep the influence of structural forces can be. Labour markets have seen major structural changes since the Great Inflation of the 1970s. Their net effect has been to reduce the pricing power of labour. This secular decline reflects many factors, including a declining role of the public sector in setting wages; dwindling unionisation; a wave of labour market deregulation; the gradual opening of markets due to globalisation; and demographics. For instance, it is hard to imagine that the bargaining power of labour, especially in advanced economies, could have remained immune to the entry of large numbers of (predominantly low-wage) workers into the the global trading system. China and former members of the Soviet bloc are the most prominent examples. A quickening of technological change is yet another possible factor, in this case increasing the competition between labour and capital. Measuring pricing power is not straightforward. For example, it may not be the actual entry of firms that determines their pricing power but the threat of entry (“contestability”). Similarly, the actual extent to which jobs are relocated to foreign countries may be less important than the threat thereof. Again, labour markets can help illustrate the point. One possible, albeit imperfect, indicator of labour’s decreasing structural pricing power is the secular decline in the degree of centralisation of wage negotiations (Graph 5.A). Another is the reduction in the number of countries adopting binding norms in the coordination of wage-setting (Graph 5.B).

The BIS provides this beautiful but ominous set of graphs to demonstrate the retreat of collective bargaining.

As the BIS explicitly recognizes, the collective mobilization and demobilization of organized labour is not independent of underlying inflationary conditions and expectations but determined by them.

if sufficiently high and persistent, inflation will influence the structural features of wage- and price-setting. The higher the inflation rate, the greater the incentive for workers to unionise, and for wage negotiations to be centralised, as the inflation rate acts as a stronger focal point.19 And, the more persistent the inflation rate, the greater the incentive to index wages and, more generally, to reduce the length of contracts that are fixed in nominal terms.20 These forces are amplified by the stylised fact that higher inflation rates tend to go hand in hand with higher volatility and hence uncertainty.

Conversely, of course, once a low-inflation regime takes hold all of these effects go into reverse. The lower the inflation rate the lower the incentivize to unionize, to insist on centralized collective bargaining and to agree to extended binding contracts.

The inflationary regime shapes the labour market institutions and those labour market institutions shape the inflationary regime.

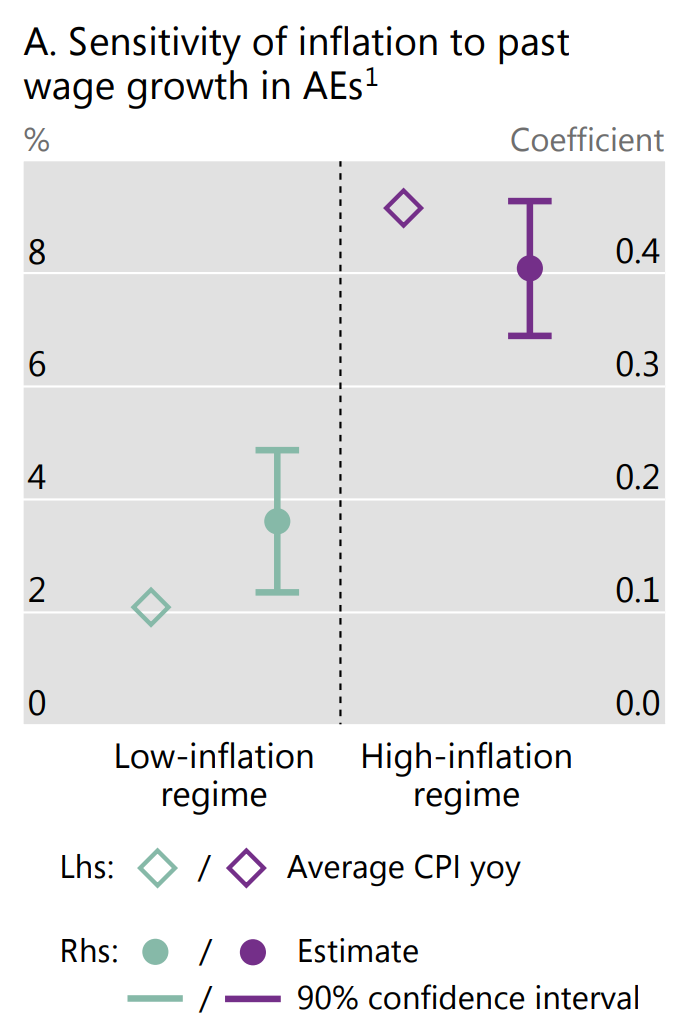

When workers’ bargaining power is high, the cyclical sensitivity of inflation to the unemployment gap increases, reflecting greater pricing power for any given degree of tightness in labour markets.15 Moreover, workers are better placed to successfully negotiate higher wages to reap the benefits of increases in labour productivity as well as to recoup losses in purchasing power due to past inflation … once wage-price spirals set in, they develop an inertia that is not easy to break. Expectations of persistent inflation become embedded in labour contracts and wage negotiations, requiring a larger reduction in aggregate demand, and hence higher unemployment, to break the back of persistent inflation. Monetary policy’s task becomes much harder. This is true not only from a technical standpoint, but also from a political one. A broad political consensus that inflation must be brought back under control would greatly help the central bank’s task. For example, it could be instrumental in inducing trade unions to accept the abandonment of indexation clauses, as it did in the 1980s.27

And this effort in persuasion had real effects. As the BIS demonstrates, since the 1990s the sensitivity of wages to past price increases has sharply declined.

At the same time, across advanced economies price increases have become much less sensitive to wage pressure.

This entire analysis is lucid and empirically rich. But what is also remarkable is how unreflected it with regard to broader trade-offs. The BIS, writing from the central bankers point of view, clearly prefers a situation that is more manageable, in other words a low-inflation regime in which labour (along with other price-setters) is disempowered.

Though it does not say so in so many words, de facto, in the current era, the first round shock in an inflationary process comes from the side of the price of goods. So preferring to dampen second round reactions effectively implies favoring producers over workers.

This becomes particularly evident when the Annual Economic Review turns to the current inflationary surge.

On its face, according to the BIS’s own definition, our current condition does not actually meet the criteria of a sustained inflation. Why? Because the price surge is too one-sided. It has been driven by costs, demand pressure and mark ups. Real wages have fallen sharply. There is very little evidence of a sustainable wage price spiral in either the US or Europe. So there are first round effects, but no more than a muted second round reactions.

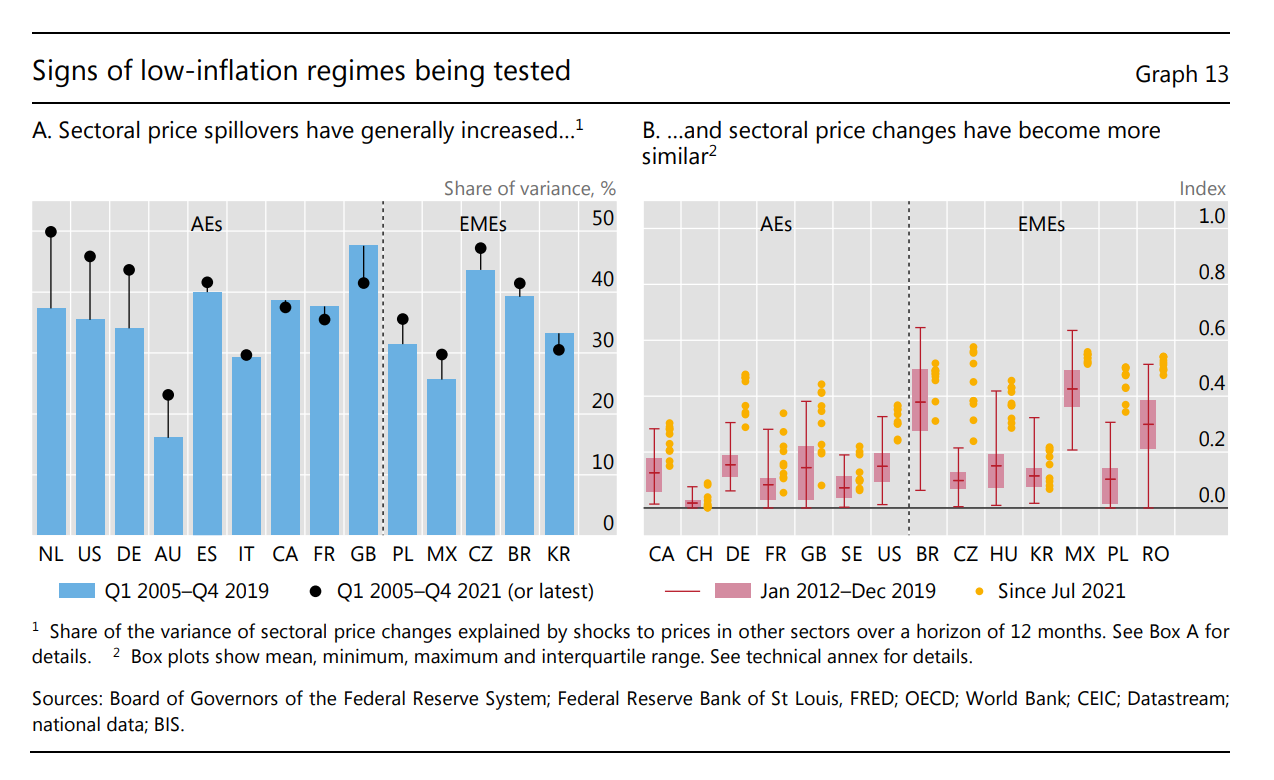

What worries the BIS are the signs that this is changing. What worries the BIS are not just much higher inflation rates, but the signs that the price system is beginning to move, once again, as though it were a single system, moved by a common orientation towards (higher) inflation. Since the summer of 2021, sectoral spillovers have increased and sectoral price changes have become more similar.

And what really worries the BIS is that this may soon spillover from the price of goods and services to wage-setting. As it puts it:

Ultimately, the most reliable warning indicator is signs of second-round effects, with wages responding to price pressures, and vice versa. These can be especially worrying if they go hand in hand with incipient changes in inflation psychology. Examples include demands for greater centralisation of wage negotiations or indexation clauses, or surveys indicating that firms have regained pricing power, as part of broader changes in the competitive environment, as observed in some countries recently (Chapter I).

The question that the BIS does not pose, is the distributional one. Clearly, if your only aim is inflation control, stopping “second round effects” must be your top priority. And the emergence of new social arrangements that institutionalize those second-round effects suggests a regime shift. But what are the distributional effects if there is no second-round response and no institutional change? Who wins and who loses?

Is the fight against inflation good for everyone?

The BIS may be of the view that on welfare and social justice grounds, low-inflation regimes dominate higher inflation regimes. But it nowhere spells out that argument. If that assumption does not hold, then favoring a low-inflation regime implies a distributional and a political choice.

And, more fundamentally, to view social and economic power, strictly from the point of view of price and wage setting is reductive. Indeed, it is reductive to view those institutions simply from the point of view of distribution.

Institutions of collective bargaining are not merely mechanisms for wage and price setting. One may value collective bargaining institutions in their own right, as complex articulations of social reality and as places where solidarity finds organized expression. One may value them as expressions of alternative visions of social balance. Up to the 1980s, organized labour was the backbone of social democratic politics and a partner of liberalism in the fashioning of democracy in capitalist societies.

Trade unions and structures of collective bargaining at all levels mattered not only because they counterbalanced elite power, but also because they gave intelligent and articulate expression to working-class grievances. They framed inequality in terms of social realities rather than imaginary enemies. Historically they did so in direct opposition to other forms of popular political mobilization - like fascism, for example. In recent decades it is not implausible to suggests that the rise of working-class support for nationalist populism is directly related to the decay of those collective institutions of labour organization.

Beyond the question of inflation-control, what kind of political economy do we want? One in which there are individual workers, firms, markets and representing the collective good is the prerogative of the central bank? Or are there other regimes that we might find preferable, in which individual, group and collective interests be articulated in more complex, pluralistic arrangements? Liberal corporations was one such model. That is the model that was swept away in the move to the low-inflation regime since the 1980s.

Would that make the politics of price-setting and price control more complicated, more “political” and more contentious? Yes it probably would. But any technocrat who celebrates the decline of the bargaining power of organized labour because it makes inflation-control easier, should not complain about the rise of troublesome populism!

*****

I love writing Chartbook and I am particularly pleased that it goes out free to thousands of readers all over the world. But it takes a lot of work and what sustains the effort is the support of paying subscribers. If you appreciate the newsletter and can afford a subscription, please hit the button and pick one of the three options.