In early February 2022 - remember back then when inflation was still our principal concern - the ECB signaled a hawkish turn on monetary policy. What happened next? Italian and Greek debt sold off and their 10-year yields popped.

It wasn’t a crisis by any means, but the tremor was significant enough to set nerves twitching. The last thing Europe needs right now is a new sovereign debt crisis.

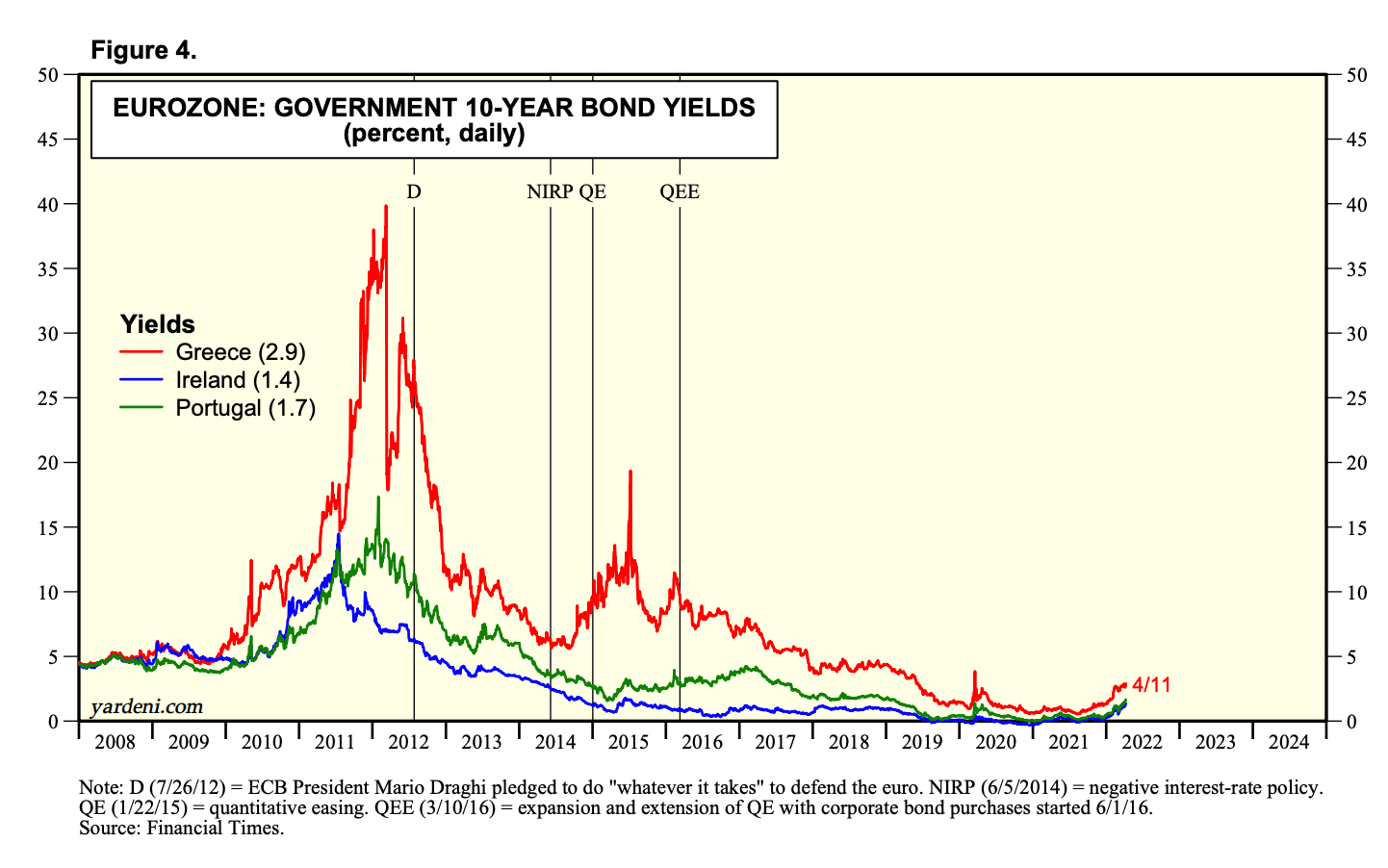

Two months on, the level of Greek yields is still elevated. This graph by Yardeni Research puts things in perspective. The current yield on the thinly traded market for 10-year Greek bonds is 2.9 %. That is not 40% as in 2011 - just ahead of restructuring. But it is by some margin the highest in the eurozone. 50 basis points ahead of Italy.

There is a reason that Italy hogs all the attention. Its debts are far larger. And they are held either by private investors (Italian and foreign) or by the ECB. By contrast, as a result of the restructuring in 2012, the overwhelming majority of Greek debt is inter-governmental or held by international organizations, principally in the EU. That means that market pressures are held in check and Greece services its debts at subsidized rates. The ESM (European Stability Mechanism) has a good summary of all the different ways in which Greek debt service costs are massaged down. On average, Greece pays a rate of 1.39 on its loans from the European Stability Mechanism.

That also means, however, that the politics of Greek debt are unmediated. It is government on government, tax-payer on tax-payer.

On April 4 2022 the Greek government announced that it had repaid the last of the 28 billion euros that the IMF had provided in funding in 2010 and 2014. 1.9 billion euros were still outstanding and they were the most expensive debts on Greece’s books. By paying off the IMF, Greece saved 230 million euros in debt service costs. To make that payment Athens needed the permission of the ESM, which waived the requirement that Greece make proportional early reimbursement of its loans to EU authorities. Everything is political.

IMF, EMS, proportional payments … just like that, we are back in the dark night of the debt crisis. Or not?

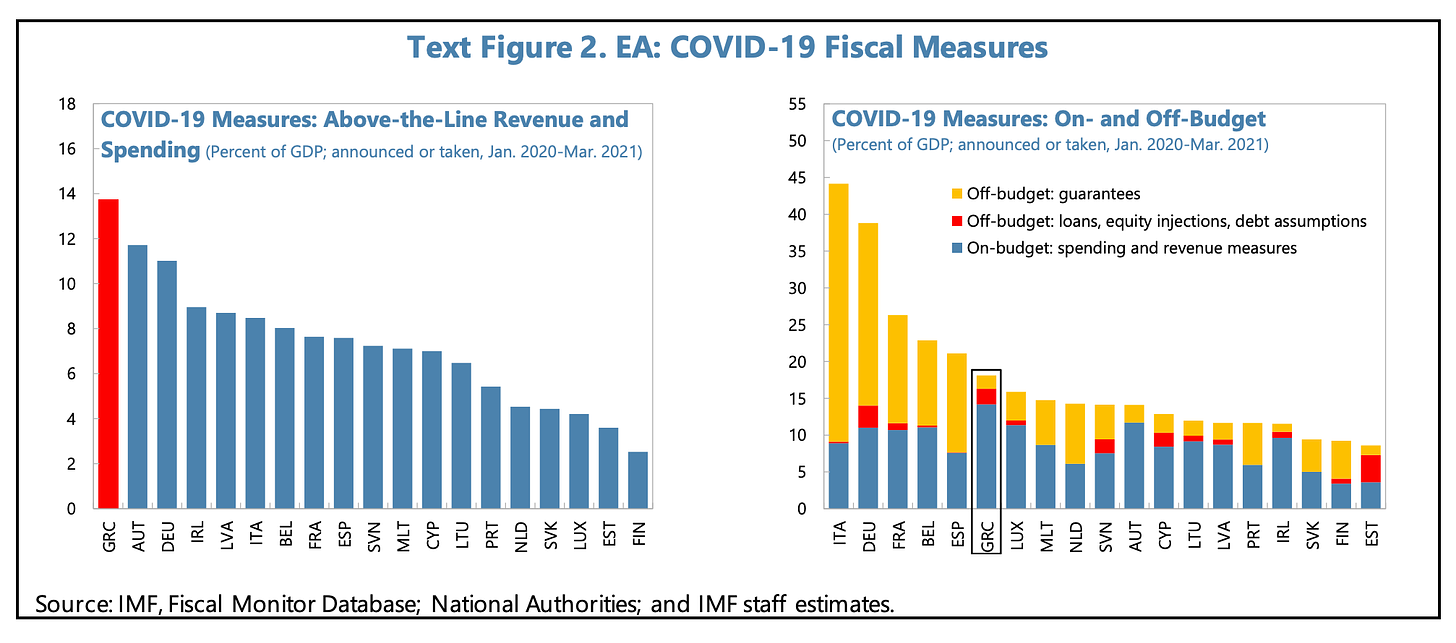

The remarkable thing is just how easily Greece came through the COVID crisis of 2020. This is despite the fact that Greece adopted what was proportionally the largest direct fiscal policy response to the COVID crisis anywhere in Europe. It needed to, In 2018 the WTTC estimated that tourism and travel contributed 20 percent to the Greek economy. If that figure seems inflated, there is no doubt that COVID was a severe shock for which the New Democracy government, despite its supposed conservative commitments, amply compensated.

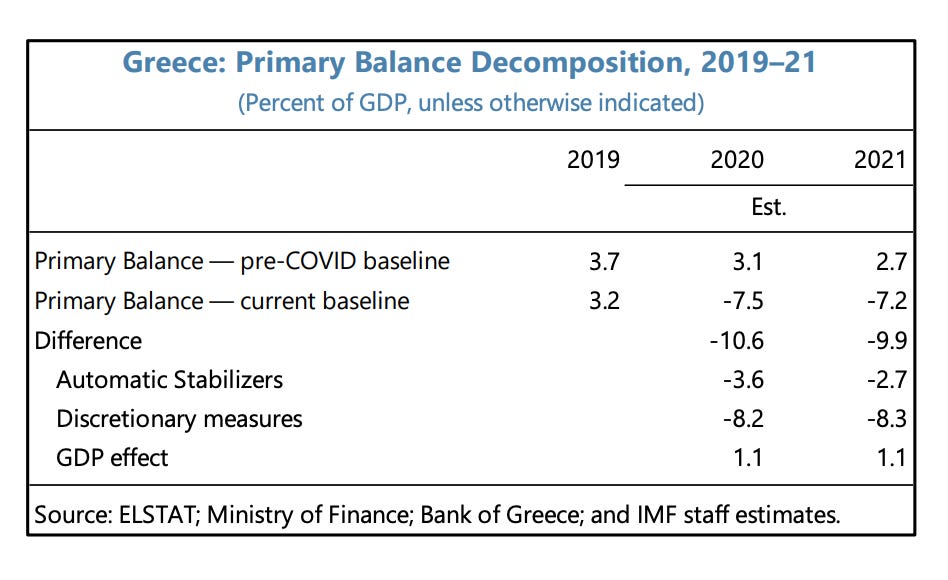

Source: IMF

Athens did not just rely on “automatic” stabilizers i.e. unemployment benefits. It delivered a big discretionary burst.

For the second time since 2008, a conservative Greek government responded to a global crisis with a huge fiscal stimulus and a surge in debt.

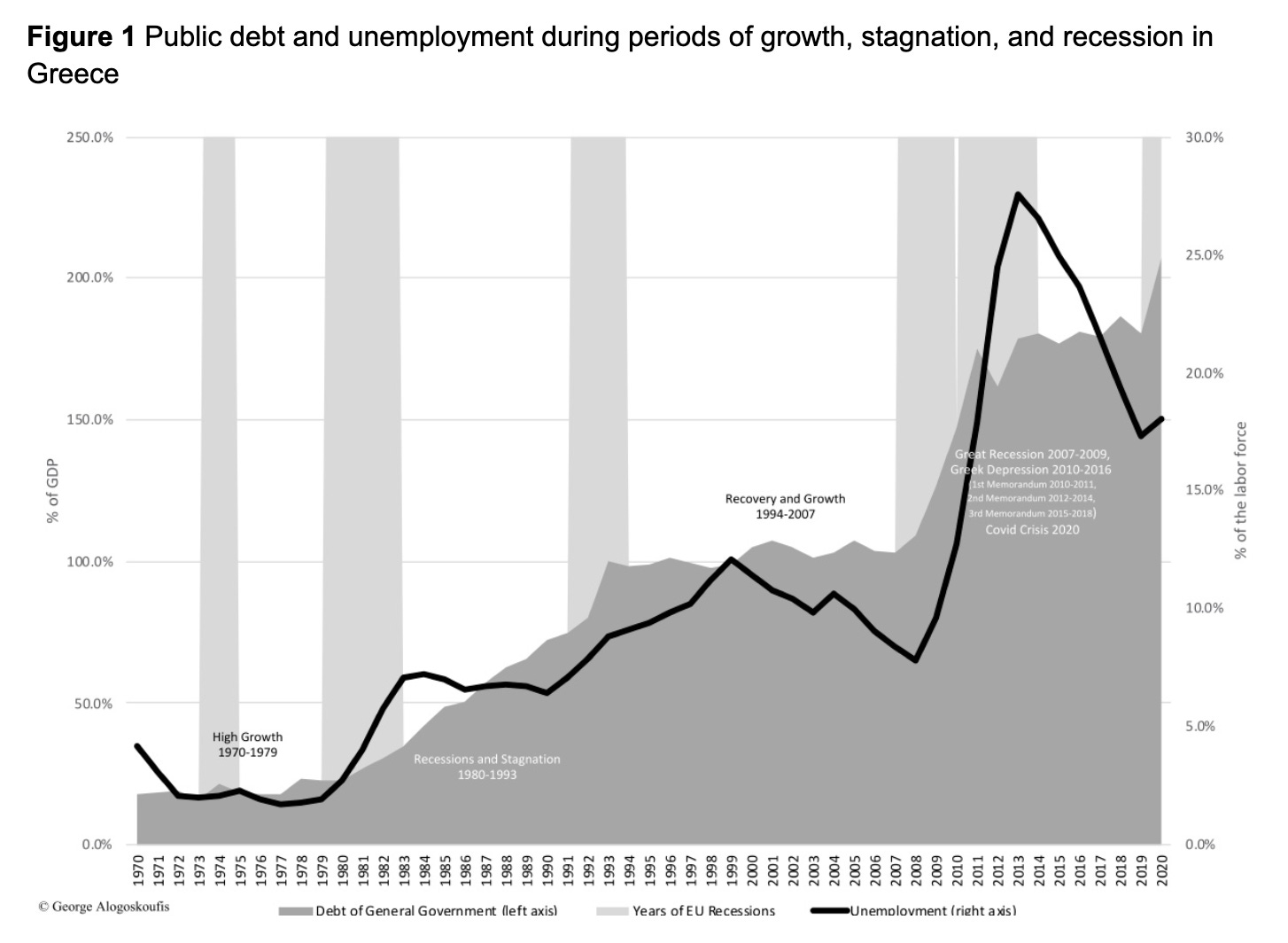

Source Alogoskoufis Voxeu

In 2009, this bequeathed to the incoming PASOK government an epic financial crisis. In 2020 at far higher debt levels, there was no reaction from debt markets. Indeed, until the ECB’s swerve to conservatism in early 2022, Greek yields were at historic lows.

Why the calm? Because unlike after 2009, in 2020 the vast majority of Greece’s debt was already in public hands and the ECB was scooping up the rest.

Hitherto the ECB had been barred from doing this. To be included in the normal ECB Asset Purchase Program, a country has to have an investment grade rating, which Greece lost in 2009. In 2015, when Mario Draghi launched QE for the Eurozone, rather than helping Greece it boxed the left-wing Syriza government in. Whereas all other members were supported, Greece was left at the mercy of the markets. And because of ECB support there was no risk of contagion spreading from Greece to any other member states. Athens lost all bargaining power.

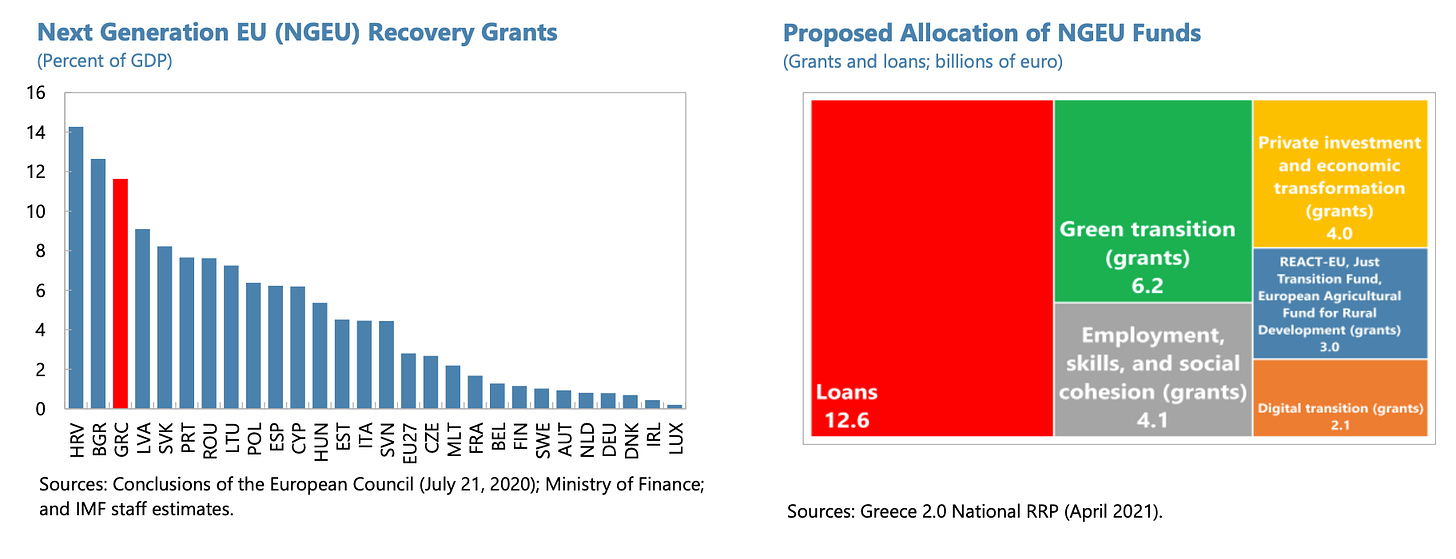

By contrast, in 2020 under the pandemic purchase program, the ECB was free to intervene. Even as Greek debt surged to the dizzying level of 220 percent of GDP, yields remained contained. On top of that, Greece under Prime Minister Kyriakos Mitsotakis is one of the largest recipients of NextGen EU aid.

On that basis, despite the setback of the crisis, Greece’s government makes a cheerful prognosis of economic growth with real GDP rising on official projections from just under 170 billion euros in 2020 to just shy of 210 billion by 2025. The IMF is slightly less optimistic, but there is no doubt that in 2021 Greece was one of the fastest growth rates in Europe. And far from arguing for restraint and urgent fiscal consolidation, the IMF’s advice to Athens in the spring of 2022 was complacent. Avoiding economic “scarring” was the priority (sic).

The fiscal adjustment should be gradual and growth friendly. The mission recommended a gradual consolidation path to achieve a primary surplus of 2 percent of GDP by 2027, underpinned by credible measures. Plans for permanent cuts in social security contributions and in the solidarity tax for all taxpayers should be reversed, as they shift the burden to future generations and are poorly targeted, or at least fully funded through benefit adjustments respectively base‑broadening measures. The mission welcomed improvements in the fiscal mix achieved during the pandemic, notably higher health care spending and public investment, and emphasized that these gains should not be sacrificed to achieve consolidation targets. Instead, spending pressures on pensions and civil service wages should be contained, including by respecting the pension freeze this year and the indexation formula from next year onwards. There remains ample scope to improve the fiscal policy mix further by phasing out transfers to public enterprises and fuel subsidies over the medium term and tackling tax evasion by the self-employed to make room for critical social spending and recurrent investment needs once NGEU funding ends. Accelerating fiscal structural reforms would facilitate these efforts.

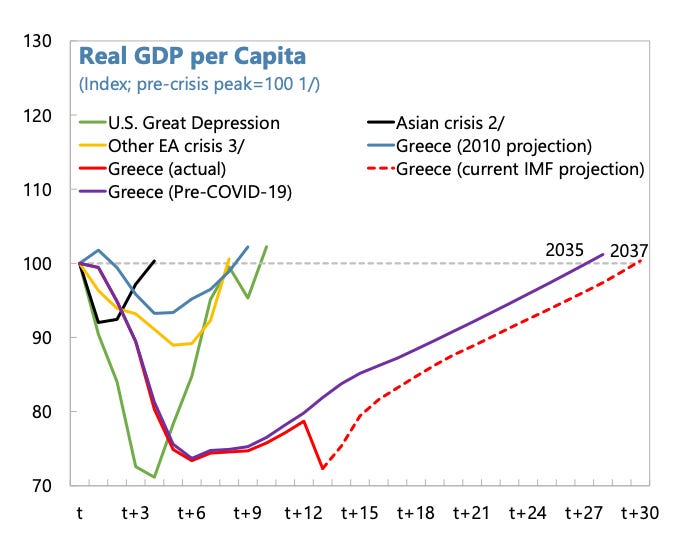

To put it mildly, this was not the advice that Athens received between 2010-2018. After 2009, on the basis of faulty economic predictions and bad economics, Greece was driven into one of the most devastating economic crises on record. As bad, but far more sustained than America’s Great Depression of the 1930s.

Source: IMF

As employment collapsed, unemployment surged to 28 percent.

Looking back on this devastating experience, which shocked Greek society and broke the back of first PASOK and then Syriza, my hosts on a recent trip to Greece, the newly-founded progressive research institute Eteron wondered out loud: “Was it us who had to pay the price so that the IMF and the EU learned their lesson?”

And now with the ECB signaling a turn to rigor and the clock running out on the Pandemic Purchase Program, the question is how long can the calm continue?

Greece remains a nation under surveillance. To keep the debt politics show on the road, Greece’s future is mapped as far ahead as 2060. That is further ahead than the anthropocenic timescale of climate politics!

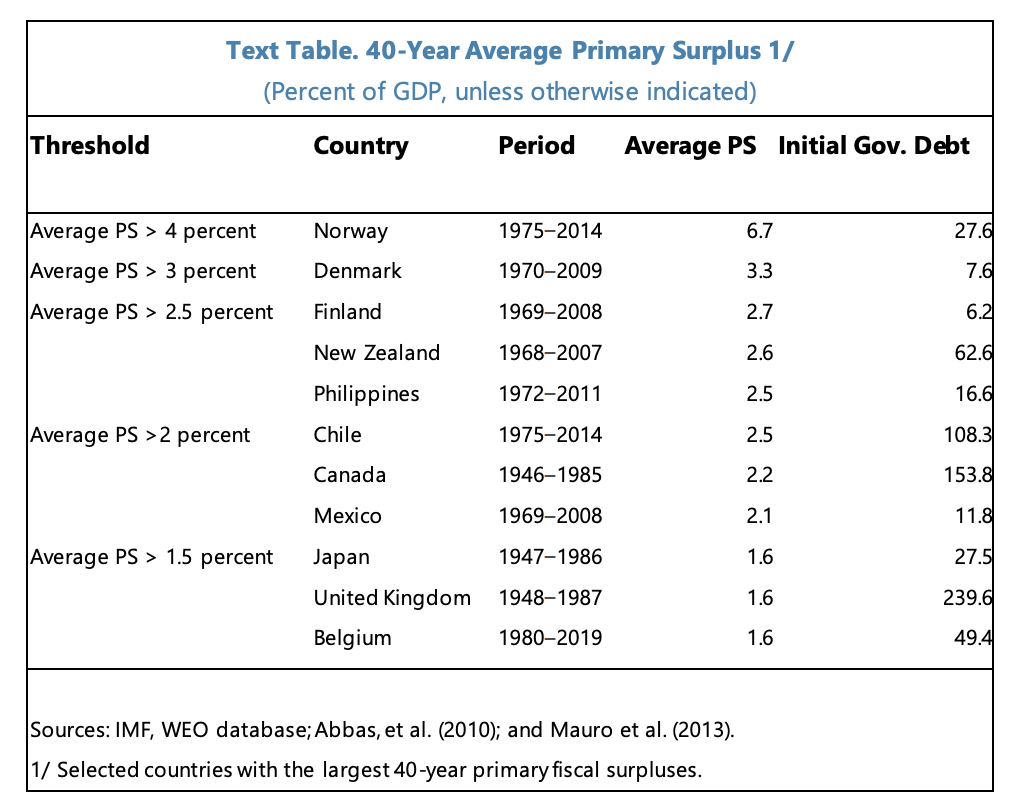

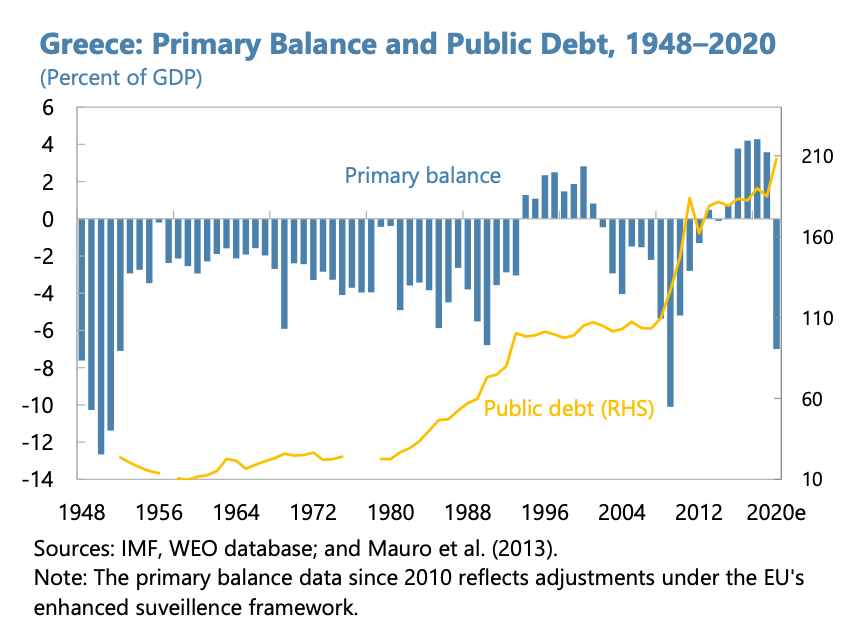

Under its “enhanced surveillance regime” the European Commission has even managed to construct a “baseline” scenario in which Greek debt falls to 60 percent of GDP by 2060, thus meeting the Maastricht criteria under which Greece entered the Euro back in 2001. To generate that prediction, all you have to assume is that interest costs remain under control. Greece runs a primary budget surplus of 2.2 percent of GDP for forty years and, at the same time, sustains nominal GDP growth close to 4 percent. What you have not to do is to linger over how realistic any of that is.

In fact, in the economic history of comparable societies, the IMF could find only eight examples since 1945 of countries that have managed sustained primary surpluses of more than 2 percent over 40 years. Since 2008 the only country to achieve that feat was oil-exporter Norway, and it fell off the wagon in 2014.

As far as Greece is concerned, the IMF concludes, to imagine that a sustained surplus of 2.2 of GDP is possible goes against all previous experience.

The largest surplus that the IMF considers viable in the long-run for Greece is 1.5 percent of GDP. A debt sustainability analysis conducted on that basis results in a range of plausible scenarios in which debt stabilizes between 160 and 120 percent of GDP by 2060. To aim for any tighter fiscal policy is likely to be counterproductive both in political and economic terms. As the IMF comments:

Greece’s long-term debt sustainability hinges on long-term fiscal discipline to sustain a high level of primary surplus, structural reforms to unlock long-run growth potential, and stable financing conditions to contain the risk-free rate and risk premium. A continued active debt management strategy will also be critical, …The scenario analysis shows that fiscal underperformance (due to policy choices and/or shocks), growth disappointments, a return to historical levels of risk-free rates, stronger sensitivity of risk premiums to debt levels, and/or shortening of new debt maturities would quickly lead to unsustainable debt dynamics over the long-term, necessitating policy adjustment and/or further financial support from European partners.

Given all of those imponderables, the IMF concludes:

… Greece’s long-term debt dynamics are too uncertain to reach a firm conclusion

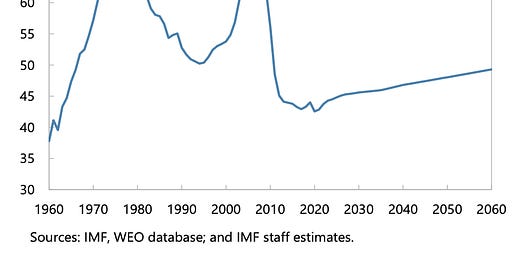

The one thing that does seem clear, however, is that Greece’s story of convergence with Western Europe is over. The single most staggering graph in the IMF’s Article IV assessment from the summer of 2021 is this one:

Twice over Greece has experienced an optimistic boom, bringing it within striking distance of German GDP per capita. Twice over it has been shocked off that growth path. Once in the 1980s and then, even more savagely, after 2009. None of the future scenarios envisioned by the debt analysis implies strong convergence over the next forty years.

Instead what Greece experiences is chronic underemployment and a serious shortfall, relative, to other EU members, in vital social spending on childcare, housing and other key benefits. The principal victims of this shock and the ensuing dislocation and diminished expectations are young people. It is for that reason, that the Eteron Institute is turning its attention above all to generation Z.

It is early days for an Institute that hopes not just to serve as a platform for new thinking, but also to shape opinion. As veterans of the first Syriza government, the organizers of Eteron are clear-eyed about the challenges this involves. It was eye-opening at the Delphi Economic Forum to discuss the dimensions of the global policycrisis and its implications for Greece with Gabriel Sakellaridis Eteron’s founding director and spokesman in 2015 for the Tsipras government.

Again and again - in the revolution of 1821, the population exchange of 1923, the aftermath of World War II, the Cold War and the financial crisis of 2008 - Greece has been a fulcrum of history. It is beautiful, littered, literally, with ancient and modern culture and, at the same time it is a laboratory, not to say a petri dish of radical change. In the decades ahead, whether it be the politics of the welfare state, intergenerational equity, climate change, the refugee crisis or the geopolitics of the Eastern Mediterranean, Greece will be in eye of the storm.

The current macroeconomic climate makes this a pretty scary moment for Greece.

The covid crisis was a current account shock as tourism was practically wiped out. Thanks to inflation and the rising price of Greece’s energy imports, the deficit didn’t really shrink much after people start to take foreign vacations again. But if the current account deficit doesn’t shrink substantially soon, then either fiscal policy needs to stay looser for longer, or the private sector borrowing needs to do more lifting by taking on more debt.

But the former requires political support from official-sector creditors, and the mood music there is currently more about the need for Greece to start tightening soon. Rising yields are making people nervous about the debt again — this could impact real economic activity as “fragmentation” (in ECB speak) gums up the transmission mechanism.

A private sector credit boom seems unlikely given the reticence of banks to lend at such a scale. This was the case even before monetary conditions tightened — and its hard to see Greece experiencing a localised pocket of easing liquidity as things get tighter everywhere else. Even if credit did expand on a huge scale, the implications of that for financial stability don’t bear thinking about for too long.

This brings us back to the current account. If financial flows — whether to the public or to the private sector — can’t support the current account deficit at its current level, then the likelihood is that the gap will close through import compression. In other words, a recession. This is how Greece brought its external sector into balance during the crisis decade.

Greece will not be the last EU country to be put on a half century long payment plan.