When hydrogen burns it leaves water. Though as a gas it is not dense, by weight hydrogen is three times energy-denser than kerosene. Hydrogen is also the most abundant element in the universe and H2 can be produced by electrolysis by applying an electric current to water. Electricity in turn can be generated from the wind and sun. So, for a society that is wedded to combustion in so many dimension of life, if we want to go on burning gas to heat our homes and drive our vehicles and even to generate power, the question presents itself: is “green” hydrogen a way to an energy transition in which everything must change, so that everything stays the same?

***

Right now there is a huge rush of excitement around hydrogen as a fuel of the future. On the latest episode of Ones and Tooze, Cameron Abadi and I took up the issue of hydrogen:

What exactly is green hydrogen, and what can it be used for?

What are the obstacles to its widespread use?

And if hydrogen did become widely used, who would be the world’s hydrogen powers?

Those are a few of the questions that came up in the conversation in Ones and Tooze. You can listen and read more here.

***

Already one hundred and fifty years ago Jules Verne touted hydrogen as a possible fuel. In the late 1960s GM showed off its electrovan powered by a hydrogen fuel cell. In the 1990s and 2000s the hydrogen economy was again in vogue. President Bush and Governor Schwarzenegger were both fans. But again and again, the great hydrogen revolution failed to materialize. H2 began to acquire the reputation as the fuel that had the brightest future and always would have.

But history is not fate. And our times are different. Whereas, previously, hydrogen was touted as an alternative to petrol. The urgency of the climate agenda and the push for net zero has widened its role. Green hydrogen is no longer seen just as a long-shot substitute for gasoline. It is touted as the Swiss army knife of the energy transition, suitable for applications across industry, transport, agriculture, home-use and for the power sector itself.

In recent years a huge coalitions of corporate interests has assembled behind green hydrogen. The Hydrogen Council, launched at Davos in January 2017, has grown into a massive corporate array advised by top tier consultancy McKinsey.

The governments of the United States, the EU, Uk, Canada, India and Japan have all, in the last 12 months initiated major programs of support for hydrogen. Within the first 12 months of the Biden Presidency the Department of Energy launched an “Earth Shot” dedicated to slashing the cost per unit of hydrogen. The Inflation Reduction Act offers subsidies for green hydrogen production, which in the best case add up to $3 per kg of hydrogen, enough to transform the economics of the industry.

The political rhetoric is overblown. As Michael Liebreich notes:

German Chancellor Olaf Scholz has called hydrogen “the gas of the future” and promised “a huge boom.” Japan’s Prime Minister Fumio Kishida has declared that “shifting to and developing a hydrogen society is critical for achieving decarbonization.” Frans Timmermans, the EU Executive Vice-President for the European Green Deal believes that “hydrogen rocks.” Jacob Rees Mogg, briefly UK Secretary of State for Energy this year, called hydrogen “the silver bullet”.

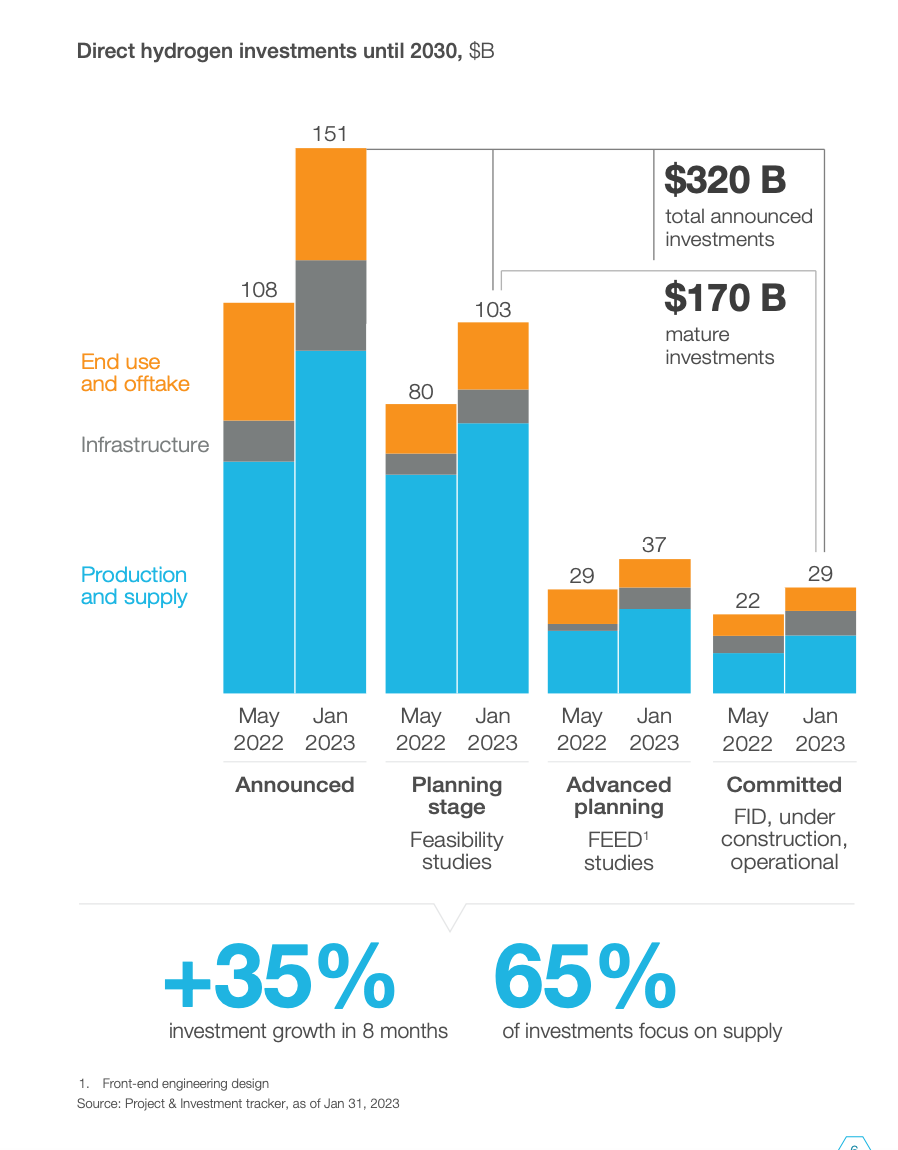

And business has reacted. Vast schemes budgeted at hundred of billions of dollars are being touted all over the world. One recent compilation found that hydrogen projects currently under discussion totaled a staggering 957 GW in electrolyzer capacity. The Hydrogen Council and the IEA settle more modestly for a figure of 500 GW by 2050. Currently, the combined rating of all hydrogen electrolyzers in operation around the world is less than 1 GW.

The hype around hydrogen is indicative of the way in which the energy transition has morphed, some might say mutated, into an industrial policy race with hundreds of billions in subsidy, markets numbered in trillions and huge slices of the economic structure up for grabs.

The good news is that investment is finally increasing to a really significant level. Bloomberg counted $1.1 trillion going into the energy transition in 2022.

This surge in spending is good news, but what is less clear is the direction of travel. This need not be seen as a bad thing. It would be naive to imagine that a process as complex as the energy transition can be planned decades in advance from the top down. Governments, businesses, producers and consumers are all embarked on a process of experimentation and learning. And, by their decision, weighted highly unequally, they are creating facts on the ground, which if not irreversible certainly imply long-term commitment.

Whereas expanding solar and wind capacity and rolling out EVs and charging infrastructure are relatively uncontroversial and dominate the number to date. The same cannot be said for hydrogen. Hydrogen may burn relatively cleanly and yield electricity through fuel cells, but since hydrogen has to be produced through the application of energy, the process is inherently inefficient. Why not simply apply the electricity you are using to make hydrogen to the task at hand?

The members of the hydrogen coalition are all obviously incumbent fossil fuel and petrochemical interests looking for a bridge to the new era. If realized, their ambitious hydrogen projects may overload the available supply of green power, for little real benefit. By diverting badly needed clean power, green hydrogen vanity projects may even slow down the energy transition. And the subsidy regimes that are being put in place could become self-perpetuating. As Gernot Wagner and Danny Cullenward recently warned, “hydrogen could become the next corn ethanol”, a ruinously inefficient and environmentally damaging creature of subsidies that are too big to kill.

***

What hydrogen exposes is that there is still huge uncertainty about many basic parameters of the low-carbon future, about the technologies that will emerge as dominant, the likely structure of prices and the patterns of supply and demand for key materials and other inputs.

Some of this uncertainty is captured in the range of models with which we plot the net-zero future.

As the International Energy Agency reported in a useful summary:

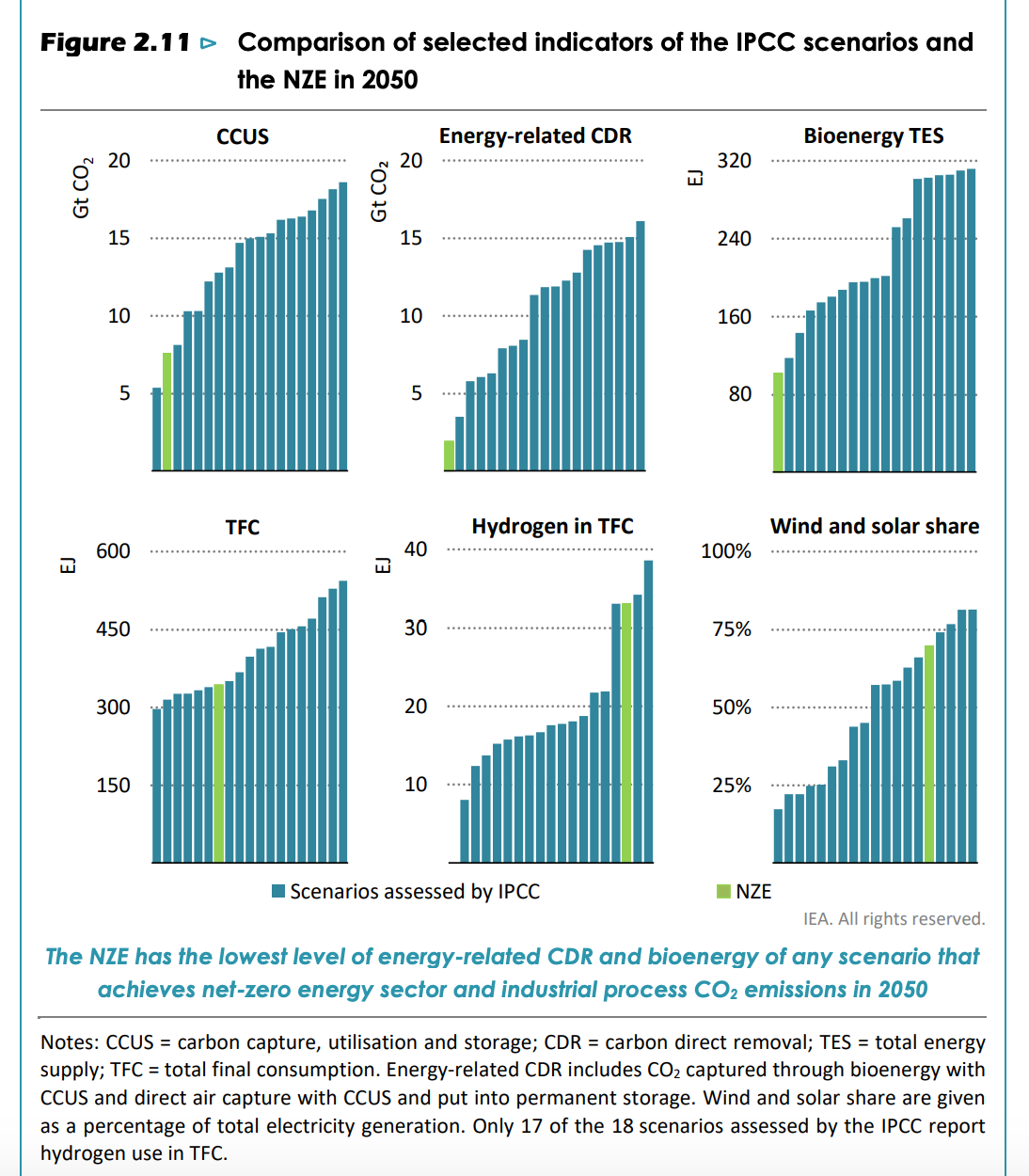

The Intergovernmental Panel on Climate Change SR1.5 includes 90 individual scenarios that have at least a 50% chance of limiting warming in 2100 to 1.5 °C (IPCC, 2018).9 … 18 of these scenarios have net‐zero CO2 energy sector and industrial process emissions in 2050.

As the IEA’s summary makes clear, these 18 scenarios differ substantially in basic parameters even including the share of wind and solar in the final power mix.

Source: IEA

The scenario highlighted in green in this graphic is the IEA’s own net zero scenario published in the spring of 2021, which serves as an influential benchmark for many further calculations and planning by other agencies and businesses.

In three quarters of the net zero scenarios evaluated by the IPCC and the IEA, hydrogen plays a relatively niche role. But in a minority of them, including the influential IEA report, its share of final energy consumption is far more prominent.

If you look beneath the headlines, even in the ranks of the Hydrogen Council, a degree of uncertainty and hesitancy is obvious. Of the $320 billion projects under discussion, only $29 billion, less than ten percent of the total, are fully committed and under construction. This hedging has consequences. As impatient hydrogen advocates like the IEA warn, it puts in question the ability to meet ambitious production targets by 2030.

***

The uncertainties in the hydrogen equation are both on the demand- and he supply-side.

The vast capacity figures called for by 2050 are arrived at by adding up every conceivable use of hydrogen, many of which are debatable and even contentious.

The oldest of the causes with which hydrogen is associated is transport. In fact the first internal combustion engine-driven car was a horseless carriage devised by Swiss inventor de Rivaz in 1807. It ran on hydrogen stored in a balloon.

Today Toyota is very much an outlier in the automobile industry in remaining heavily committed to hydrogen fuel cell technology, as opposed to battery-powered EV. At the Olympic games in 2021, visitors were ferried around Tokyo in Toyota hydrogen-powered vehicles. It may prove to be their swan song. Hyundai also continues to commit to hydrogen. But the expense of the technology and the lack of fueling infrastructure makes it very improbable that they will ever challenge the battery-driven revolution in motor vehicles. The area where hydrogen fuel cells may find a place on the road is in heavy-duty trucking. Toyota has a working partnership with Kenworth to produce fuel-cell powered big rigs. They have survived trials at the Port of LA, one of the world’s most important transport hubs and are now being rolled out nationwide. In the Uk Ford is trialing hydrogen-fueled heavy goods vehicles with Ocado the online grocery store.

In the skies Airbus is pursuing hydrogen powered aviation. It is developing multiple prototypes both using hydrogen combustion and fuel cells to power long-range flight. Airbus hopes to have testbeds flying by 2025, followed by prototypes and true zero-emission commercial airliners by 2035. Safran, a French engine-maker that supplies Airbus, has confirmed it is looking at hydrogen power for commercial aircraft. As promising as this may be, the real question is why would Airbus spurn high performance biofuels as a cheaper and more obvious alternative.

Maersk the shipping giant is another member of the hydrogen club. It has recently announced that as a first big step to decarbonizing its fleet it will source 6 mil. tonnes per annum of green methanol per year by 2030. Maersk are forging partnerships with the Spanish government amongst others to ensure those huge supplies. It will commission a fleet of 19 vessels capable of running on green methanol between 2023 and 2025 and has already announced a total of seven strategic partnerships to secure the volumes needed to meet the demands of these initial vessels.

Outside transport, the most recent hydrogen enthusiasm is green steel. This is promising, indeed many regard it as indispensable. Hydrogen features in these prototypes not as a fuel to heat giant blast furnaces in the way coal and gas still do, but as a reducing agent to chemically transform the iron ore. The heating is done with green electricity. The problem is scale and efficiency and concerting a giant global industry. So far 20 of the 19 green steel experiments are in Europe and Europe is far from being the hub of the global steel industry, which now revolves around China. Furthermore, the scales of energy needed are daunting. As Leigh Collins notes, the average EU steel plant would need a whopping 1.2GW of electrolysers and 4.5GW of solar to decarbonise. That is more green hydrogen capacity than currently exist in the world.

Another favorite is the idea of using hydrogen as a long-term energy store. Intermittency is the major challenge of converting to renewable electricity generation. Batteries are the obvious short-term solution. But they cannot hold charge over a period of months to compensate for seasonal fluctuations. In Utah and elsewhere giant salt caves are being prepped to receive huge volumes of hydrogen produced during peak wind and sun periods. The question however, given the cost of electrolyzer facilities, is whether it will make sense to hold hydrogen-making capacity in reserve for the seasonal surge in renewable power. Stored hydrogen will never be competitive with gas produced from well-run continuous operations and will the existence of reserve socks distort the market for regular producers?

The most far-fetched idea and the one that raises most skepticism is the push by the gas industry to see hydrogen as a substitute for natural gas in domestic applications. As Emily Pontecorvo of the Grist reports the natural gas industry is fighting a fierce rearguard action to protect its huge investment in the grid by presenting hydrogen as a clean gas of the future. Quite apart from the huge task of upgrading the pipes to millions of homes, the economics of green hydrogen are terrible compared to the near magical properties of heat exchangers which cool as well as warming.

If you wave aside the skeptics and add up all these potential uses you arrive at the 500 GW scenario for green hydrogen touted by the IEA and the Hydrogen Council. Perhaps unsurprisingly the IEA thanks the Hydrogen Council for its input.

If you read Michael Liebreich you arrive at a very different conclusion. He has even assembled the degrees of hydrogen hype in a handy chart.

***

Adding to the speculative feel of the hydrogen discussion is the fact that hydrogen has never in fact been produced at scale by hydrolysis. Total global capacity is less than 1 GW. We simply don’t know if any of it can be done.

What sustains it are two cornucopian assumptions. Thanks to the huge advances made in solar and wind, it has come to seem realistic to believe in cost-cutting miracles. Learning curves and learning by doing are the order of the day. The sooner you start the better.

We currently have less than a GW of electrolyzer capacity installed in total, across the whole world. By 2050 the plans foresee 500 GW, enough to supply green hydrogen to cover all the hard to abate sectors. That is a lot of installation and so, it is promised, a lot of cost savings.

The story of solar panels and wind turbines offers a promising example of how rapidly renewable energy technologies may progress. But as Danny Cullenward stresses hydrogen is less a widget than a system and the development of systems is extremely complex and hard to predict.

The second cornucopian assumption is that once installed there will be enough renewable green electricity to power this huge fleet of electrolyzers. On some modeling a fleet of 500 GW of electrolyzers would consume no less than 30 percent of all electricity generated by 2050. Indeed, in the most optimistic modeling the giant expansion in green hydrogen demand becomes the motor for huge renewable power production.

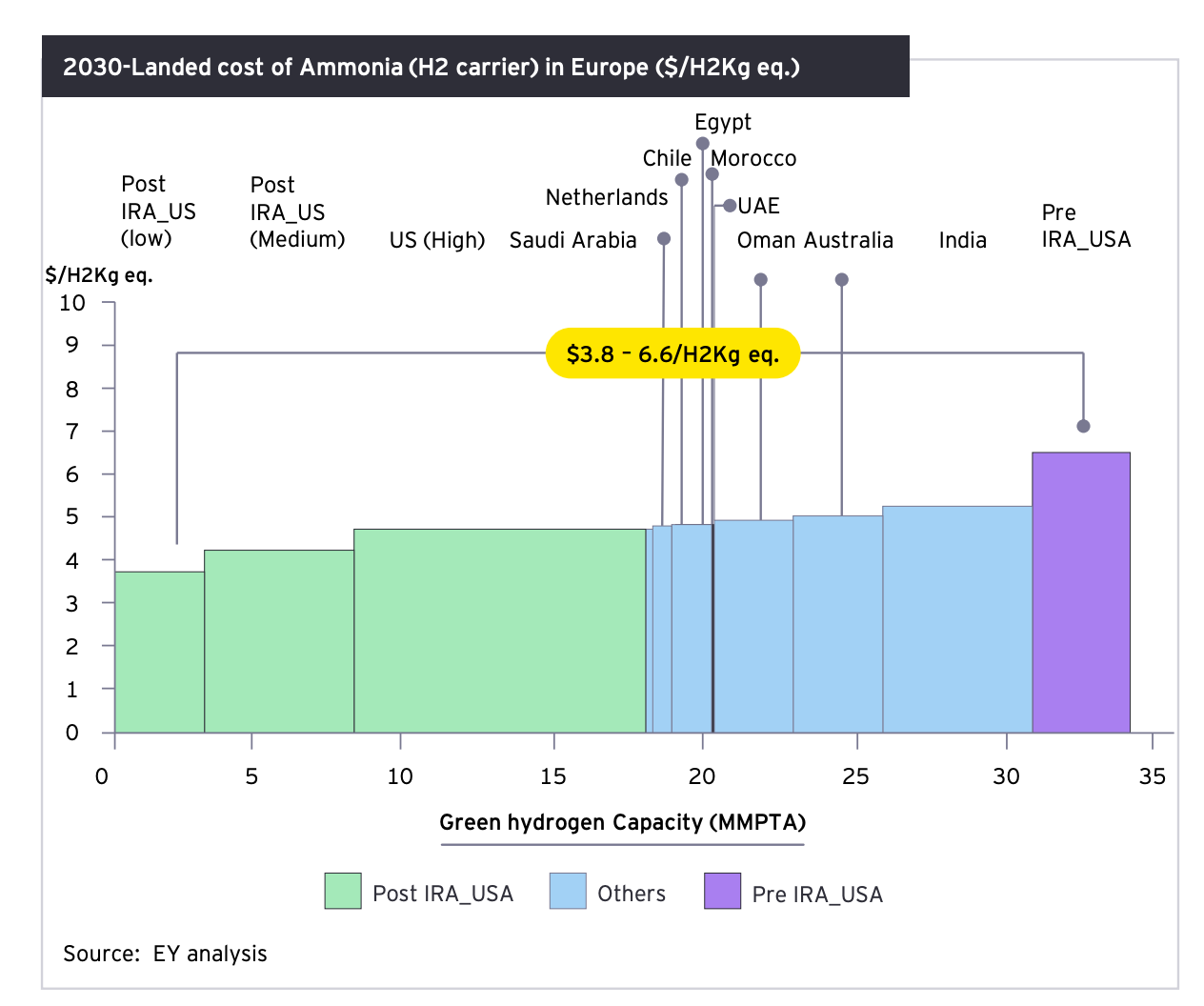

The most fervent advocates of hydrogen add a further assumption. The best way. to reduce costs is not simply to push for maximum scale, but then to combine this with trade. Clearly there are some parts of the world that will have exceptionally low costs for renewable energy. The most obvious logic would presumably to process hydrogen into ammonia and fertilizer in, for instance, Namibia, before exporting it. But the Hydrogen Council prefers to imagine H2 being traded like oil.

Japan has undertaken experiments with shipping H2, but to say that the potential for trade in hydrogen is untested is an overstatement. Nevertheless elaborate debates are already afoot about the potential shifts in the balance of global power if new centers of green hydrogen production emerge. Unless of course the giant scale of US IRA subsidies ensures that it is not natural conditions but the size of a state’s fiscal resources that are ultimately decisive.

The Just Energy Transition Partnership are intended to promote hydrogen development in, for instance, Namibia. Modi and his oligarch cronies have huge ambitions for India as a hydrogen producer. America’s huge domestic subsidies create a mountain for developing countries to climb. Whethere their ammonia will ever compete with “freedom molecules” from Texas is an open question.

The more immediate worry, however, is that making hydrogen is extremely energy intensive and we are far from living in a world in which renewable energy is abundant and low-cost. So there is a real risk that big new hydrogen projects might divert clean power from more efficient strategies for decarbonization.

This is why the key frontline in debates about the huge new hydrogen subsidies concerns additionality. First the EU and now the US are debating rules that will ensure that a surge in hydrogen production by hydrolysis does not give a new lease on life to a dirty power grid. The key questions are: does the hydrogen plant add new green capacity to the grid? Is it local to the hydrogen facility so as to avoid putting pressure on the grid? And is the power available when the electrolyzers need it? The hydrogen lobby wants the maximum flexibility on all counts. It argues in favor of accelerating the build out so as to gain learning-effects and scale-economies as quickly as possible. But every concession adds further pressure on scarce green power capacity. The EU reached a compromise in February. The US Treasury is still working on the rules.

***

In the debate about hydrogen there is one fact that too often goes unremarked. The hydrogen economy is not a hypothetical. Our economies as they stand already rely on the production of huge volumes of hydrogen for two basic chemical processes: the processing of oil and the production of fertilizer.

For these purposes we produce over 90 million tons of hydrogen annually. It is an industry worth $160 billion or so. And because hydrogen is won from natural gas and sometimes coal it is an extremely dirty process. These uses for hydrogen do no have the glamour of green aviation or fuel-cell vehicles. But they are essential and they are very dirty. Globally, hydrogen production today accounts for emissions equivalent to those of an economy like that of Germany.

These uses rank even in Liebreich’s hydrogen hierarchy at the very top. To get to net zero, whatever new uses we find for hydrogen, this existing hydrogen consumption will have to be cleaned up.

That by itself is no small job. In a medium-sized European country like the UK, replacing the current consumption of hydrogen with green hydrogen would require a huge share of renewable energy currently generated and a heavy investment in electrolytic capacity.

To some extent this demand will be eased by the winding down of the oil industry which is the major consumer of industrial hydrogen. But the rest of the chemical industry remains, most crucially of all the fertilizer industry without which we could not feed the 8 billion human inhabitants of our planet.

Viewed from the side of the investor, it is good news that there is a steady source of demand for hydrogen in existing industry. There is no speculation about the need for ammonia or methanol in industry. But that does not mean that it will be easy to swap green hydrogen for the grey hydrogen currently consumed. Above all there are locational problems. Industrial hydrogen is produced on the spot in chemicals plants. It isn’t shipped in like coal or oil or natural gas.

Creating a market for industrial green hydrogen is not simply a matter of technology. It requires the creation of a new commodity market and a new wave of highly specific investment.

BASF’s giant plant at Ludwigshafen is a case in point. Of the 1 million tons of hydrogen that BASF consumes annually in its worldwide operations, 250,000 tons are currently produced and consumed in Ludwigshafen, making it one of the biggest consumer in the world. BASF is now scrambling to build partnerships with renewable energy producers across Europe to source the power that it needs to shift to electrolysis. It has also attracted a modest amount of EU funding to support the pilot stage of its new electrolyzer plant.

Ahead of Europe the twin centers of chemical industry in the world are in China and the USA.

China is where the largest part of ammonia production and fertilizer production in the world is located. The world’s largest green fertilizer production experiment is being undertaken with eager United Nations support in Inner Mongolia and the involvement of research institutes from Tsinghua University. As one report summarizes the situation in China, momentum is building:

40 green ammonia projects reported to be in the development and pre-approval stages. The country is seemingly leapfrogging the blue ammonia approach being favoured by some other nations in Europe and the Middle East, and investing instead in large-scale green ammonia research and construction projects. One plant in the north of China, owned by Envision Energy, has a 20,000 t/yr green ammonia plant currently under construction, which will be followed by a ramp-up to 300,000 t/yr. Industry sources said that the plant, which will run on wind power and is located in Inner Mongolia, could be ready to start exporting green ammonia by late 2024. The Inner Mongolia region has increasingly become the focus for hydrogen and ammonia facilities run on renewable energy over recent months.

On the back of this wave of investment China will likely emerge as a major exporter of green ammonia but also as an exporter of facilities for the production of green ammonia in the rest of the world. First up is a cooperation with Morocco which is widely touted as a future powerhouse in green hydrogen.

Outside China and Europe, it may, in fact, be the United States and, in particular, Texas that lead the green hydrogen push that actually matters. The bipartisan infrastructure bill of 2021 offered funding for hydrogen hubs which it described as “network[s] of clean hydrogen producers, potential clean hydrogen consumers, and connective infrastructure located in close proximity... that can be developed into a national clean hydrogen network to facilitate a clean hydrogen economy”. Texas in fact has an extensive network of hydrogen pipelines interconnecting these hubs. The IRA doubled down with huge subsidies. Of all places in the world it is probably Texas that now offers the most propitious conditions for a truly rapid build out fo green hydrogen.

To shrink the trillion-dollar global energy transition down to individual investment projects in Ludwigshafen, Mongolia and Texas may seem to miss the point. And those projects and others like them can only be the beginning. But as Cullenward and Victor and Sabel and Victor have argued, it is precisely from such sectoral networks of producers and consumers that real technological and economic solutions emerge. It is at this level, in these milieu of producers and consumers that the learning entailed by the energy transition will take place, in situated practice. Where else, but in medias res?